In today’s fast-paced business environment, efficient financial management is more critical than ever. Accounting software has become an indispensable tool for businesses of all sizes, streamlining processes, improving accuracy, and providing valuable insights into financial performance. But with so many options available, choosing the right accounting software can feel overwhelming. This thorough guide will walk you through everything you need to know to select the perfect accounting software for your business. We’ll explore the key attributes to look for, the varied types of software available, and tips for achievementful implementation. Whether you’re a small startup or a large enterprise, this guide will help you make informed decisions and maximize your financial management. Let’s dive in and discover how accounting software can transform your business!

Understanding the Basics of Accounting Software. What is it? Accounting software, at its core, is designed to automate and simplify the process of managing financial transactions. Gone are the days of manual ledgers and endless spreadsheets! Modern accounting software offers a centralized platform for tracking income, expenses, assets, and liabilities. It helps businesses maintain accurate financial records, generate reports, and make informed decisions. Why is it crucial? Accurate financial data is the backbone of any achievementful business. Accounting software ensures that your financial information is organized, up-to-date, and readily accessible. This is crucial for everything from tax compliance to securing funding from investors. Moreover, it complimentarys up valuable time and resources that can be better spent on growing your business.

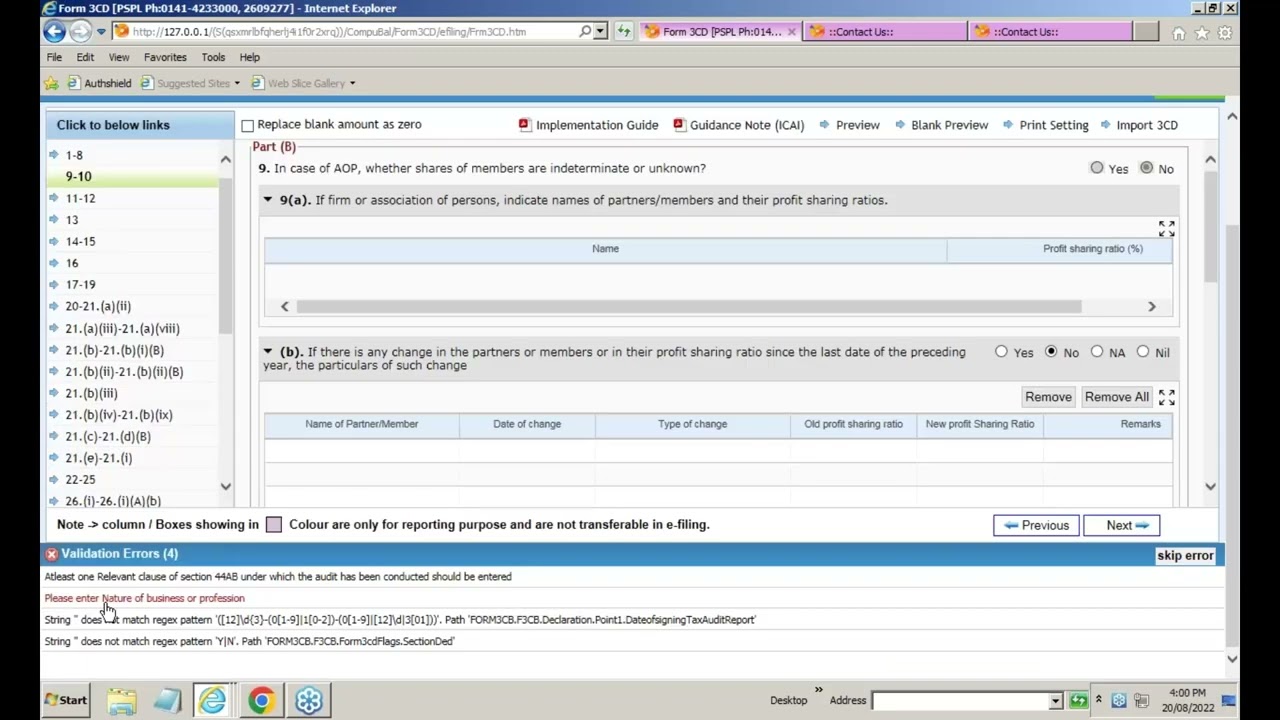

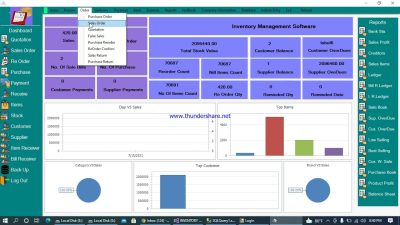

Key attributes to Look for in Accounting Software. Core Accounting functions: At a minimum, your accounting software should include attributes for managing accounts payable (AP), accounts receivable (AR), general ledger, and bank reconciliation. These are the fundamental building blocks of any accounting system. Reporting and Analytics: Look for software that offers robust reporting capabilities. You should be able to generate income statements, balance sheets, cash flow statements, and other key financial reports with ease. Customization Options: Every business is unique, so your accounting software should be flexible enough to adapt to your specific needs. Look for software that allows you to customize charts of accounts, create custom reports, and tailor the system to your industry. Integration Capabilities: Your accounting software shouldn’t operate in isolation. It should integrate seamlessly with other business systems, such as CRM, e-commerce platforms, and payroll software. This will streamline your workflows and eliminate the need for manual data entry.

Exploring varied Types of Accounting Software. Cloud-Based Accounting Software: Cloud-based accounting software is hosted on remote servers and accessed via the internet. This offers several benefits, including accessibility from anywhere, automatic backups, and scalability. Popular cloud-based options include QuickBooks Online, Xero, and NetSuite. On-Premise Accounting Software: On-premise accounting software is installed directly on your company’s computers and servers. This gives you more control over your data and security, but it also requires more IT infrastructure and maintenance. Desktop versions of QuickBooks and Sage are examples of on-premise accounting software. Enterprise Resource Planning (ERP) Systems: ERP systems are thorough business management solutions that include accounting modules along with other functionalities like inventory management, provide chain management, and customer relationship management. ERP systems are typically used by larger organizations with complex needs.

Choosing the Right Accounting Software for Your Business. Assess Your Needs: Before you start evaluating varied software options, take the time to assess your specific needs and requirements. Consider the size of your business, the complexity of your operations, and your budget. Define Your Budget: Accounting software can scope in price from complimentary to several thousand dollars per month. Determine how much you’re willing to spend on accounting software and stick to your budget. Read Reviews and Compare Options: Once you have a good understanding of your needs and budget, start studying varied accounting software options. Read online reviews, compare attributes, and ask for recommendations from other business owners. Take benefit of complimentary Trials: Many accounting software offerrs offer complimentary trials or demos. This is a great way to test out the software and see if it’s a good fit for your business before you commit to a paid access.

Tips for Implementing Accounting Software effectively. Plan Your Implementation: Implementing new accounting software can be a complex process, so it’s crucial to plan carefully. Develop a detailed implementation plan that outlines the steps involved, the timeline, and the resources required. Migrate Your Data: If you’re switching from an existing accounting system, you’ll need to migrate your data to the new software. This can be a time-consuming process, but it’s essential to ensure that your financial records are accurate and complete. Train Your Staff: Make sure your staff is properly trained on how to use the new accounting software. offer training materials, conduct workshops, and offer ongoing support. Monitor Your Progress: Once the software is implemented, monitor your progress closely to ensure that it’s working as expected. Track key metrics, such as the time it takes to process invoices and the accuracy of your financial reports.

In conclusion, selecting the right accounting software is a critical decision for any business. By carefully evaluating your needs, exploring varied options, and considering factors like scalability and integration, you can find a solution that streamlines your financial processes and contributes to your overall achievement. Don’t hesitate to leverage complimentary trials and demos to ensure the software aligns perfectly with your business requirements. Investing in the right accounting software is an investment in your company’s future!