In today’s digital age, starting a business bank account online has become a convenient and efficient way for entrepreneurs to manage their finances. An online business account offers numerous benefits, from streamlined banking to enhanced accessibility. If you’re a business owner looking to simplify your financial operations, opening an online account might be the perfect solution. This guide will walk you through everything you need to know about starting an online business account, including the benefits, key attributes to look for, top offerrs, and step-by-step instructions.

Why Open an Online Business Account?

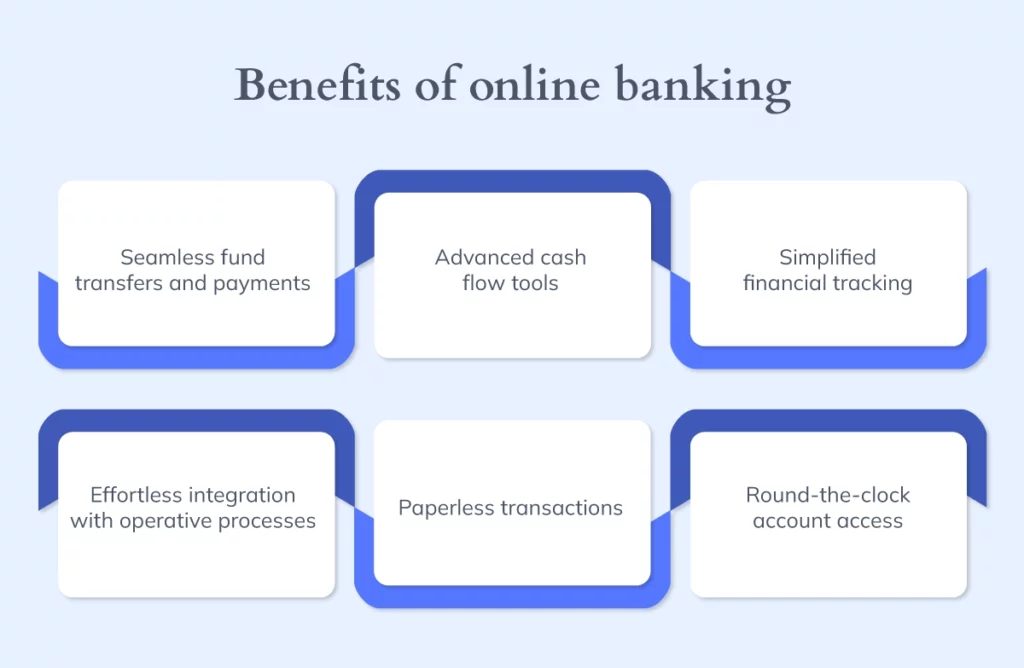

Opening a business account, especially an online account, offers several benefits:

- Separation of Finances: Keeps your personal and business finances separate, making accounting and tax preparation easier.

- Professionalism: Adds credibility to your business when dealing with clients and vendors.

- Access to Business Services: offers access to business loans, credit cards, and other financial products.

- Convenience: Online accounts offer 24/7 access to your funds and banking services from anywhere.

Key attributes to Look For in an Online Business Account

When choosing an online business account, consider these essential attributes:

- Low Fees: Look for accounts with minimal monthly fees, transaction fees, and overdraft fees.

- Transaction Limits: Understand the limits on the number of transactions you can make per month.

- Interest Rates: Some business accounts offer interest on your balance. Compare rates to maximize your earnings.

- Integration with Accounting Software: Ensure the account integrates seamlessly with your accounting software for easy reconciliation.

- Mobile Banking: A user-friendly mobile app is essential for managing your finances on the go.

- Customer Support: Check the availability and responsiveness of customer support channels.

Related Post : can i close my wells fargo bank account online

Top Online Business Account offerrs

Several reputable online banks and financial institutions offer business accounts. Here are a few top contenders:

- Novo: Known for its no-fee business checking account and integrations with popular business tools.

- Bluevine: Offers a high-yield business checking account with no monthly fees and cashback rewards.

- Lili: Designed for complimentarylancers and independent contractors, offering attributes like expense tracking and tax preparation tools.

- Mercury: A popular choice for startups, providing banking services tailored to tech companies.

- Brex: Offers a business account with rewards and expense management tools for growing businesses.

Step-by-Step Guide to Opening an Online Business Account

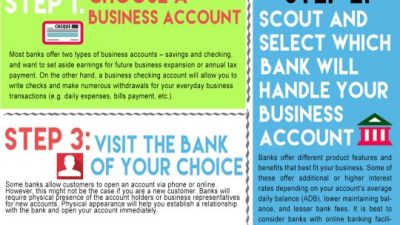

Opening an online business account is typically a straightforward process. Here’s a step-by-step guide:

1. study and Compare: Explore varied online business account options and compare their fees, attributes, and requirements.

2. Gather Required Documents: Prepare the necessary documents, such as your business formation documents (e.g., articles of incorporation or LLC operating agreement), employer identification number (EIN), and personal identification (driver’s license or passport).

3. Complete the Online Application: Visit the online bank’s website and fill out the application form. offer accurate information about your business and its owners.

4. Verification Process: The bank may require you to verify your identity and business information. This could involve uploading documents or answering security querys.

5. Fund Your Account: Once your application is approved, you’ll need to fund your account. This can typically be done through an electronic transfer, check deposit, or wire transfer.

Tips for Managing Your Online Business Account

Once your online business account is up and running, follow these tips to manage it effectively:

- Monitor Your Account Regularly: Keep an eye on your account balance, transactions, and fees to prevent surprises.

- Set Up Alerts: Configure alerts for low balances, large transactions, and unusual activity.

- Reconcile Your Account: Regularly reconcile your bank statements with your accounting records to ensure accuracy.

- Secure Your Account: Use strong passwords, enable two-factor authentication, and be cautious of phishing scams.

- Take benefit of Online Tools: Utilize the online banking tools offerd by your bank, such as bill pay, budgeting tools, and reporting attributes.

Opening a business bank account online is a smart move for any entrepreneur looking to streamline their finances and establish credibility. With numerous options available, take the time to study and select the account that optimal fits your business needs. Embrace the convenience and efficiency of online banking to set your business up for financial achievement!