In today’s fast-paced world , managing your finances efficiently is more crucial than ever. Wells Fargo Online Banking offers a convenient and secure way to handle your personal accounts from the comfort of your home or on the go. Whether you’re paying bills , transferring funds , or simply checking your balance , Wells Fargo’s online platform offers a thorough suite of tools to help you stay in control of your financial life. This article will guide you through the key attributes , security measures , and benefits of using Wells Fargo Online Banking for your personal accounts. Let’s explore how Wells Fargo , Online Banking , and Personal Accounts work together to simplify your financial management.

Getting Started with Wells Fargo Online Banking: A Step-by-Step Guide

Ready to dive in? Here’s how to get started with Wells Fargo Online Banking for your personal accounts:

1. Enrollment: If you’re a new user , you’ll need to enroll in Online Banking. Visit the Wells Fargo website and click on the “Enroll Now” button. You’ll be prompted to offer your account information , Social Security number , and other personal details to verify your identity.

2. Create a Secure Username and Password: select a strong , unique username and password. Avoid using easily guessable information like your birthday or pet’s name. Wells Fargo also offers enhanced security options like two-factor authentication for added protection.

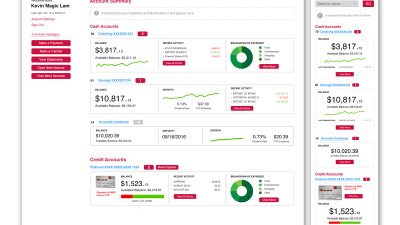

3. Explore the Dashboard: Once you’re logged in , take some time to explore the dashboard. You’ll find an overview of your accounts , recent transactions , and quick links to frequently used attributes.

4. Customize Your Settings: Personalize your Online Banking experience by setting up alerts , customizing your dashboard , and managing your communication preferences.

Key attributes of Wells Fargo Online Banking for Personal Accounts

Related Post : huntington bank online business

Wells Fargo Online Banking is packed with attributes designed to make managing your personal accounts easier than ever. Here are some of the highlights:

- Account Management: View your account balances , transaction history , and statements for all your Wells Fargo personal accounts , including checking , savings , credit cards , and loans.

- Bill Pay: Say goodbye to writing checks and mailing envelopes! With Online Bill Pay , you can schedule payments to virtually any company or individual in the United States.

- Funds Transfer: Easily transfer funds between your Wells Fargo accounts or to external accounts at other financial institutions.

- Mobile Banking: Access your accounts on the go with the Wells Fargo Mobile app. Deposit checks , pay bills , transfer funds , and more , all from your smartphone or tablet.

- Zelle: Send and receive money quickly and easily with friends and family using Zelle , which is integrated directly into the Wells Fargo Mobile app.

- Alerts: Stay informed about your account activity with customizable alerts. Receive notifications for low balances , large transactions , or unusual activity.

Enhancing Your Security: Protecting Your Wells Fargo Personal Accounts Online

Security is paramount when it comes to online banking. Wells Fargo employs a variety of measures to protect your personal accounts from fraud and unauthorized access. Here are some key security attributes:

- Two-Factor Authentication: Add an extra layer of security to your account with two-factor authentication. This requires you to enter a unique code sent to your phone or email in addition to your password when logging in.

- Fraud Monitoring: Wells Fargo actively monitors your account for suspicious activity and will alert you if anything seems out of the ordinary.

- Secure Browsing: Ensure you’re using a secure connection when accessing Online Banking. Look for the padlock icon in your browser’s address bar.

- Account Alerts: Set up alerts to notify you of any unusual activity on your account , such as large withdrawals or transactions from unfamiliar locations.

- FDIC Insurance: Rest assured that your deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250 ,000 per depositor , per insured bank.

Tips for Maximizing Your Wells Fargo Online Banking Experience

To get the most out of Wells Fargo Online Banking , consider these helpful tips:

- Set Up Recurring Payments: Automate your bill payments by setting up recurring payments for regular expenses like rent , utilities , and loan payments.

- Use Budgeting Tools: Take benefit of Wells Fargo’s budgeting tools to track your spending , set financial objectives , and stay on top of your finances.

- Monitor Your Credit Score: Keep an eye on your credit score with Wells Fargo’s complimentary credit score monitoring service.

- Go Paperless: Reduce clutter and help the environment by opting for paperless statements and notifications.

- Contact Customer Support: If you have any querys or need assistance , don’t hesitate to contact Wells Fargo’s customer support team. They’re available 24/7 to help you with any issues.

Troubleshooting Common Wells Fargo Online Banking Issues

Even with the optimal technology , occasional issues can arise. Here are some common problems you might encounter with Wells Fargo Online Banking and how to troubleshoot them:

- Forgot Username or Password: If you’ve forgotten your username or password , click on the “Forgot Username/Password” link on the login page and follow the instructions to reset it.

- Login Issues: If you’re having trouble logging in , make sure you’re using the correct username and password. Also , check your internet connection and try clearing your browser’s cache and cookies.

- Bill Payment Problems: If a bill payment fails , check your account balance to ensure you have sufficient funds. Also , verify that you’ve entered the correct payee information.

- Mobile App Issues: If you’re experiencing problems with the Wells Fargo Mobile app , try updating to the latest version or reinstalling the app.

- Security Concerns: If you suspect fraud or unauthorized access to your account , contact Wells Fargo immediately.

In conclusion , Wells Fargo Online Banking offers a robust and convenient platform for managing your personal accounts. With its thorough attributes , enhanced security measures , and user-friendly interface , it’s a valuable tool for anyone looking to streamline their financial life. Whether you’re paying bills , transferring funds , or simply keeping track of your finances , Wells Fargo Online Banking offers the resources you need to stay in control.