In today’s digital age, managing your business finances online has become not just a convenience, but a requirement. An online business account offers a streamlined, efficient, and cost-effective way to handle your company’s financial transactions. But with so many options available, how do you select the right one? This thorough guide will walk you through everything you need to know about online banking for businesses, from understanding the benefits to selecting the perfect platform. Let’s dive in!

Why select an Online Business Account?

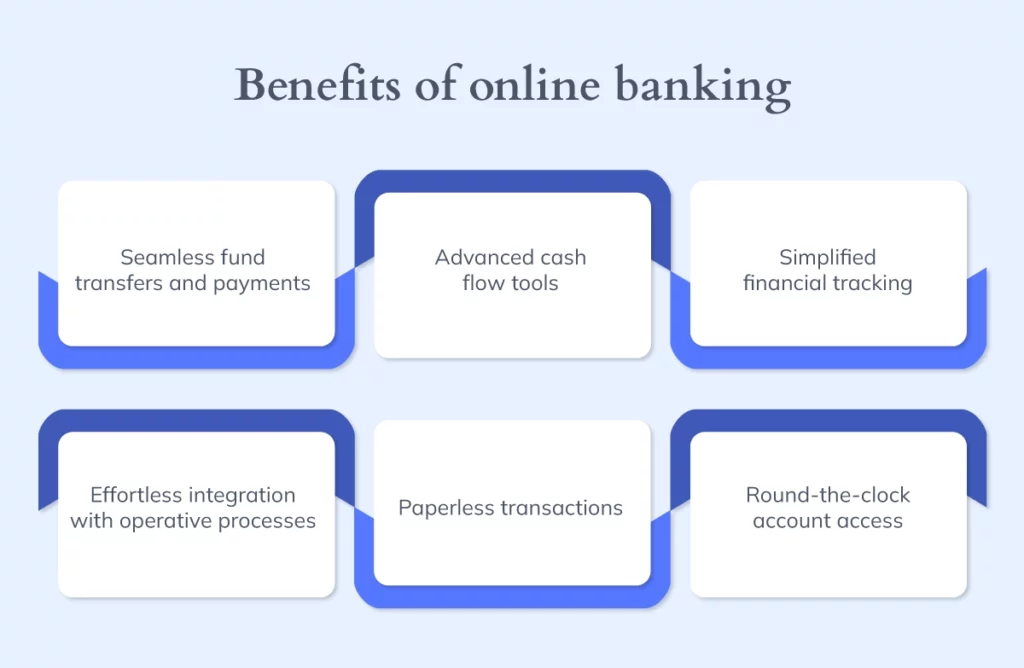

In today’s fast-paced digital world, traditional banking methods can often feel cumbersome and time-consuming. Online banking offers a refreshing alternative, providing a scope of benefits tailored to the needs of modern businesses. One of the most significant benefits is convenience. With 24/7 access to your account from anywhere with an internet connection, you can manage your finances on your own schedule. No more rushing to the bank during business hours or waiting in long lines!

Another key benefit is efficiency. Online banking platforms often come equipped with tools that automate tasks such as invoicing, bill payments, and payroll. This not only saves you valuable time but also reduces the risk of human error. Plus, many online business accounts offer seamless integration with popular accounting software, making it easier to track your income and expenses.

Cost savings are also a major draw for many businesses. Online accounts typically have lower fees compared to traditional bank accounts, and some even offer rewards programs or cashback on purchases. This can add up to significant savings over time, complimentarying up capital for other crucial investments in your business.

Related Post : huntington bank online business

Key attributes to Look for in an Online Business Account

When choosing an online business account, it’s essential to consider the attributes that are most crucial to your specific needs. Here are some key attributes to look for:

- Transaction Limits: Understand the daily and monthly transaction limits to ensure they align with your business volume.

- Fee Structure: Scrutinize the fee structure, including monthly maintenance fees, transaction fees, and overdraft fees.

- Integration with Accounting Software: Check if the online account integrates seamlessly with your preferred accounting software, such as QuickBooks or Xero.

- Mobile Banking: Ensure the platform offers a user-friendly mobile app for convenient banking on the go.

- Customer Support: Look for reliable customer support options, such as phone, email, or live chat, in case you encounter any issues.

- Security Measures: Prioritize accounts with robust security measures, such as two-factor authentication and fraud monitoring, to protect your financial data.

Comparing Popular Online Banking Platforms

With so many online banking platforms available, it can be challenging to select the right one for your business. Here’s a brief overview of some popular options:

- Novo: Known for its sleek interface and focus on small businesses, Novo offers complimentary business checking accounts with no monthly fees or minimum balance requirements.

- Bluevine: Bluevine offers high-yield business checking accounts with interest rates that are significantly higher than traditional banks. They also offer lines of credit to help businesses manage their cash flow.

- Mercury: Mercury is a popular choice for startups and tech companies, offering a scope of attributes designed to support their unique needs, such as API access and venture debt financing.

- Brex: Brex caters to larger businesses and offers a thorough suite of financial tools, including corporate credit cards, expense management software, and treasury management services.

When comparing these platforms, consider factors such as fees, interest rates, attributes, and customer support to determine which one optimal aligns with your business objectives.

Opening Your Online Business Account: A Step-by-Step Guide

Opening an online business account is typically a straightforward process. Here’s a step-by-step guide to help you get started:

1. select a Platform: study and compare varied online banking platforms to find the one that optimal suits your needs.

2. Gather Required Documents: Prepare the necessary documents, such as your business license, EIN (Employer Identification Number), and personal identification for all authorized users.

3. Complete the Application: Fill out the online application form, providing accurate and complete information about your business.

4. Verify Your Identity: You may be required to verify your identity through a video call or by uploading a copy of your driver’s license or passport.

5. Fund Your Account: Once your application is approved, you’ll need to fund your account with an initial deposit. This can typically be done through a bank transfer or by mailing a check.

6. Start Banking: Once your account is funded, you can start using the online banking platform to manage your finances, pay bills, and track your transactions.

Tips for Maximizing Your Online Banking Experience

To make the most of your online banking experience, here are some helpful tips:

- Set Up Alerts: Configure alerts to notify you of crucial account activity, such as low balances, large transactions, or suspicious activity.

- Use Strong Passwords: Create strong, unique passwords for your online banking account and change them regularly.

- Monitor Your Account Regularly: Check your account activity frequently to determine any unauthorized transactions or errors.

- Take benefit of Automation: Utilize the automation tools offered by your online banking platform to streamline tasks such as invoicing and bill payments.

- Stay Informed: Keep up-to-date with the latest security threats and optimal practices for online banking to protect your financial data.

In conclusion, choosing the right online business account is a pivotal decision that can significantly impact your company’s financial health and operational efficiency. By carefully evaluating your business needs, comparing varied online banking platforms, and understanding the associated fees and attributes, you can find an online account that perfectly aligns with your objectives. Embrace the convenience and innovation of online banking to streamline your financial management and propel your business towards achievement!