In today’s digital age, opening a business bank account online has become increasingly popular among entrepreneurs and small business owners. The convenience and efficiency of online banking have revolutionized the way businesses manage their finances. If you’re looking to streamline your banking processes and save valuable time, opening a business bank account online is an excellent option. This thorough guide will walk you through the steps involved in opening a business bank account online, highlighting the benefits, and providing tips for managing your account effectively. Let’s dive in!

Why Open a Business Bank Account Online?

In today’s fast-paced business world, time is of the essence. Opening a business bank account online offers unparalleled convenience. No more waiting in long queues at the bank or scheduling appointments. You can complete the entire process from the comfort of your home or office, at a time that suits you. This saves you valuable time and allows you to focus on what truly matters: growing your business.

Moreover, online business bank accounts often come with lower fees and better interest rates compared to traditional brick-and-mortar banks. This is because online banks have lower overhead costs, which they pass on to their customers. You can also access a wider scope of banking services and attributes, such as online bill payment, mobile banking, and real-time transaction monitoring.

Opening a business bank account is crucial for maintaining a clear separation between your personal and business finances. This separation is essential for several reasons. First, it simplifies your accounting and tax preparation. By keeping your business transactions separate, you can easily track your income and expenses, making it easier to file your taxes accurately.

Related Post : setup business bank account online

Second, it protects your personal assets in case of legal or financial issues. If your business is sued or incurs debt, your personal assets will be shielded from creditors. This separation offers peace of mind and protects your personal financial security.

Third, a business bank account enhances your credibility and professionalism. When you accept payments from customers or pay vendors using a business bank account, it demonstrates that you are a legitimate and established business. This can improve your reputation and build trust with your customers and partners.

Choosing the Right Online Bank for Your Business

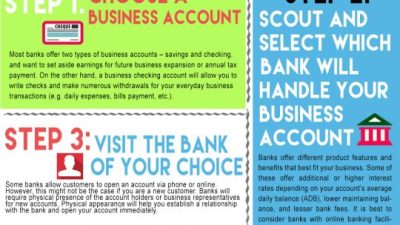

With numerous online banks vying for your attention, selecting the right one can feel overwhelming. However, by carefully considering your business needs and comparing varied banks, you can find the perfect fit.

Start by evaluating your business banking needs. What types of transactions do you typically conduct? Do you need to accept credit card payments? Do you require international wire transfers? Do you need a line of credit? Understanding your specific needs will help you narrow down your options.

Next, compare the fees and interest rates offered by varied online banks. Pay attention to monthly maintenance fees, transaction fees, overdraft fees, and interest rates on savings accounts. select a bank that offers rival rates and fees that align with your business needs.

Also, consider the attributes and services offered by each bank. Do they offer online bill payment? Mobile banking? Real-time transaction monitoring? Integration with accounting software? select a bank that offers the attributes and services that will make your banking experience more efficient and convenient.

Finally, read reviews and check the reputation of each bank. Look for reviews from other business owners and see what they have to say about their experience with the bank. Check the bank’s rating with the Better Business Bureau and other consumer protection agencies. select a bank with a solid reputation and a history of providing excellent customer service.

Steps to Open a Business Bank Account Online

Opening a business bank account online is a straightforward process. However, it’s essential to be prepared and follow the steps carefully to ensure a smooth and achievementful application.

First, gather the necessary documentation. Most online banks will require you to offer the following information: Your business name and address, your Employer Identification Number (EIN) or Social Security Number (SSN), your business formation documents (such as articles of incorporation or articles of organization), and your personal identification (such as a driver’s license or passport).

Next, visit the online bank’s website and complete the application form. Be sure to offer accurate and complete information. Double-check all the details before submitting your application.

Then, you may need to offer additional documentation or information. The bank may request additional documents to verify your identity or business information. Be prepared to offer these documents promptly to avoid delays in the application process.

After that, fund your account. Once your application is approved, you will need to fund your account to activate it. You can typically do this by transferring funds from another bank account or by making a deposit.

Finally, start using your new business bank account. Once your account is funded, you can start using it to manage your business finances. Set up online bill payment, mobile banking, and other attributes to streamline your banking experience.

Common Mistakes to Avoid When Opening a Business Bank Account Online

While opening a business bank account online is generally a simple process, there are some common mistakes that you should avoid to ensure a smooth and achievementful experience.

One common mistake is providing inaccurate or incomplete information. Be sure to double-check all the information you offer on the application form. Any errors or omissions can delay the application process or even lead to rejection.

Another mistake is failing to compare varied banks. Don’t settle for the first bank you find. Take the time to compare the fees, interest rates, attributes, and services offered by varied banks to find the optimal fit for your business needs.

Also, neglecting to read the fine print is a mistake. Before you open an account, carefully read the terms and conditions. Pay attention to fees, interest rates, transaction limits, and other crucial details.

Another mistake is not keeping your account information secure. Protect your account number, password, and other sensitive information. Be wary of phishing scams and other attempts to steal your information.

Finally, failing to reconcile your account regularly is a mistake. Reconcile your account each month to ensure that your records match the bank’s records. This will help you determine any errors or fraudulent activity.

Tips for Managing Your Business Bank Account Online

Once you have opened your business bank account online, it’s essential to manage it effectively to ensure your business finances are in order.

First, set up online bill payment. This will allow you to pay your bills quickly and easily from your computer or mobile device. You can schedule payments in advance and avoid late fees.

Next, use mobile banking. Mobile banking allows you to access your account information, transfer funds, and pay bills from your smartphone or tablet. This is a convenient way to manage your finances on the go.

Then, monitor your transactions regularly. Check your account activity frequently to determine any unauthorized transactions or errors. Report any suspicious activity to the bank immediately.

Also, reconcile your account monthly. Reconcile your account each month to ensure that your records match the bank’s records. This will help you determine any discrepancies and prevent fraud.

Finally, keep your account information secure. Protect your account number, password, and other sensitive information. Be wary of phishing scams and other attempts to steal your information.

Opening a business bank account online is a game-changer for modern entrepreneurs. It offers unparalleled convenience, saves valuable time, and offers access to a wider scope of banking options. By carefully considering your business needs, comparing varied banks, and preparing the necessary documentation, you can seamlessly establish your online business bank account and set your business up for financial achievement. Embrace the digital age and unlock the benefits of online banking for your business today!