In today’s digital age, setting up a business account online has become an increasingly popular and convenient option for entrepreneurs. With the rise of online banking, businesses can now manage their finances from anywhere, at any time, without the need to visit a physical branch. This article will guide you through the process of setting up a business account online, highlighting the benefits, key attributes to look for, and common mistakes to avoid. Whether you’re a startup or an established company, understanding how to navigate the world of online banking is crucial for financial achievement. Let’s dive in and explore how you can streamline your business finances with an online bank account !

Why select Online Banking for Your Business Account ?

Online banking offers a plethora of benefits over traditional brick-and-mortar banks. The convenience of managing your finances from anywhere, at any time, is a major draw. No more rushing to the bank during business hours or waiting in long queues. With online banking, you have 24/7 access to your account, allowing you to monitor transactions, pay bills, and transfer funds with ease. This flexibility is particularly beneficial for small business owners who often juggle multiple responsibilities.

Moreover, online banks often offer rival interest rates and lower fees compared to traditional banks. This can translate to significant cost savings for your business over time. Many online platforms also offer integrated accounting tools and attributes that simplify financial management, making it easier to track income, expenses, and cash flow. The efficiency and cost-efficacy of online banking make it an attractive option for businesses of all sizes.

Key attributes to Look for in a Business Account

Related Post : can i open a bank account online capital one

When selecting a business account, it’s crucial to consider the specific attributes that align with your business needs. Look for accounts that offer unlimited transactions, as this can save you money if you have a high volume of transactions each month. Integration with accounting software like QuickBooks or Xero is another valuable attribute, as it streamlines your bookkeeping processes and reduces the risk of errors.

Mobile banking capabilities are also essential in today’s fast-paced business environment. Ensure that the bank offers a user-friendly mobile app that allows you to manage your account on the go. attributes like mobile check deposit, bill payment, and fund transfers can significantly enhance your efficiency. Additionally, consider the availability of customer support. Opt for a bank that offers multiple channels of support, such as phone, email, and live chat, to ensure that you can get assistance whenever you need it.

Step-by-Step Guide to Setting Up a Business Account Online

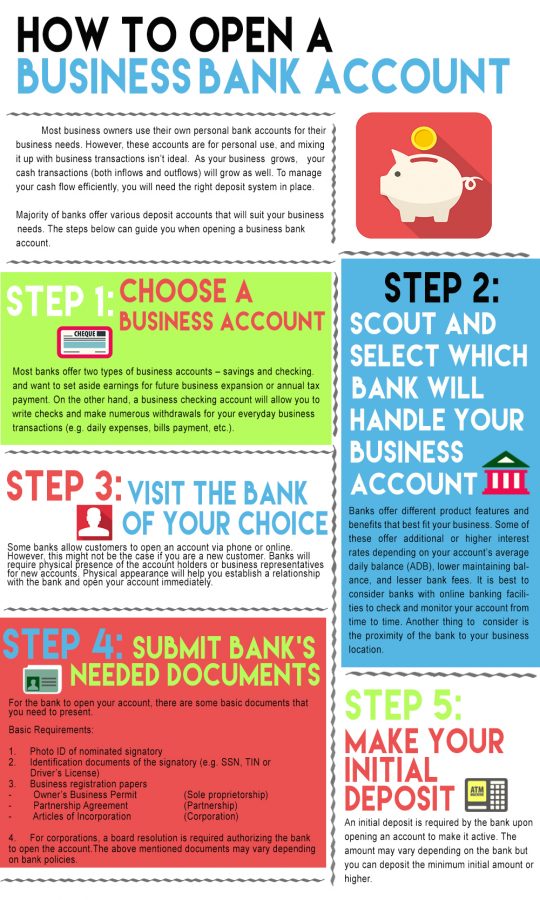

Setting up a business account online is a straightforward process, but it requires careful attention to detail. Here’s a step-by-step guide to help you navigate the process:

1. study and Compare Banks: Start by studying varied online banks and comparing their offerings. Look at factors such as fees, interest rates, transaction limits, and available attributes. Read reviews and testimonials from other business owners to get a sense of their experiences.

2. Gather Required Documentation: Before you begin the application process, gather all the necessary documentation. This typically includes your Employer Identification Number (EIN), business license, articles of incorporation or organization, and personal identification documents for all authorized signatories.

3. Complete the Online Application: Visit the bank’s website and complete the online application form. Be prepared to offer detailed information about your business, including its legal structure, industry, and annual revenue. Ensure that all information is accurate and consistent with your business records.

4. Verification and Approval: Once you submit your application, the bank will verify the information and conduct a background check. This process may take a few days to a few weeks, depending on the bank’s procedures. If your application is approved, you will receive instructions on how to activate your account and start using it.

5. Fund Your Account: After your account is activated, you will need to fund it to start using it. You can typically do this through an electronic transfer from another bank account or by depositing a check. Be sure to check the bank’s minimum balance requirements to avoid any fees.

Common Mistakes to Avoid When Opening a Business Account

While setting up a business account online is generally easy, there are some common mistakes that you should avoid. One of the most frequent errors is providing inaccurate or incomplete information on the application form. This can lead to delays in processing or even rejection of your application. Double-check all the information you offer to ensure its accuracy.

Another mistake is failing to read the fine print. Before you open an account, carefully review the terms and conditions, including the fee schedule, transaction limits, and other crucial details. This will help you avoid any surprises down the road. Additionally, be sure to select an account that aligns with your business needs. Don’t simply opt for the cheapest option without considering the attributes and services that are most crucial to you.

Tips for Managing Your Business Account Effectively

Once you have set up your business account, it’s essential to manage it effectively to ensure your financial health. Regularly monitor your account activity to detect any unauthorized transactions or errors. Set up alerts to notify you of low balances or unusual activity.

Use online banking tools to automate tasks such as bill payments and fund transfers. This can save you time and reduce the risk of missed payments. Reconcile your bank statements regularly to ensure that your records match the bank’s records. This will help you determine and resolve any discrepancies promptly. Finally, consider using budgeting and forecasting tools to track your cash flow and make informed financial decisions.

Setting up a business bank account online is a game-changer for modern entrepreneurs. It offers unparalleled convenience, saves valuable time, and offers access to a suite of tools designed to streamline your financial operations. By carefully considering your business needs, comparing varied bank offerings, and preparing the necessary documentation, you can seamlessly establish an online business account that sets the stage for financial achievement. Embrace the digital revolution and unlock the potential of online banking for your business today!