In today’s digital age, opening a bank account online has become increasingly popular. Capital One , a well-known financial institution, offers a seamless online banking experience. If you’re wondering, “Can I open a bank account online with Capital One?” the answer is a resounding yes! This article will guide you through the process, highlighting the benefits of online banking and how Capital One makes it easy to manage your finances from the comfort of your home. With Capital One’s online banking platform, you can access a variety of services, including opening a bank account , managing your funds, and much more. Let’s dive in and explore how you can take benefit of Capital One’s online banking options.

Why select Capital One for Online Banking?

Capital One has emerged as a leading player in the banking industry, known for its customer-centric approach and innovative solutions. Here’s why you might consider opening a bank account online with Capital One:

- Convenience: Open an account from the comfort of your home, without visiting a physical branch.

- rival Rates: Capital One often offers attractive interest rates on its savings and money industry accounts.

- User-Friendly Platform: Their website and mobile app are designed for ease of use, making managing your finances a breeze.

- No Hidden Fees: Capital One is transparent about its fees, ensuring you know exactly what you’re paying for.

- 24/7 Customer Support: Get assistance whenever you need it with their round-the-clock customer service.

Types of Bank Accounts You Can Open Online with Capital One

Capital One offers a scope of bank accounts to suit varied financial needs. Here are some popular options:

- 360 Checking Account: A no-fee checking account with a debit card and access to online bill pay.

- 360 Performance Savings Account: A high-yield savings account with rival interest rates to help your money grow faster.

- Certificates of Deposit (CDs): Secure investment options with fixed interest rates for a specific term.

- Money industry Accounts: Accounts that offer higher interest rates than traditional savings accounts, with limited check-writing abilities.

Related Post : reconcile bank in quickbooks online

Step-by-Step Guide to Opening a Bank Account Online with Capital One

Opening a bank account online with Capital One is a simple process. Follow these steps to get started:

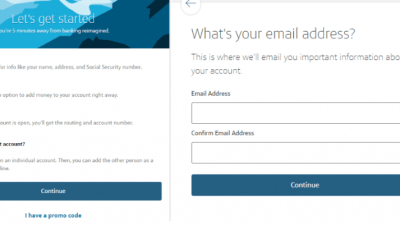

1. Visit the Capital One Website: Go to Capital One’s official website and navigate to the “Open an Account” section.

2. select Your Account Type: select the type of bank account you want to open (e.g. , checking, savings).

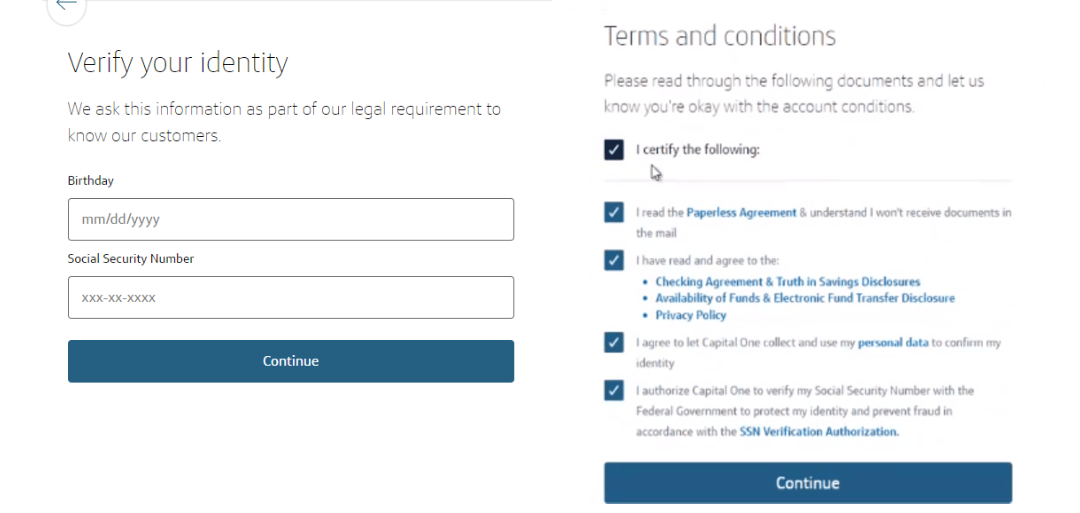

3. Complete the Application Form: Fill out the online application form with accurate personal and financial information. This typically includes your name, address, date of birth, Social Security number, and employment details.

4. Verify Your Identity: Capital One may require you to verify your identity by providing a copy of your driver’s license or other government-issued ID.

5. Fund Your Account: Make an initial deposit to activate your account. You can usually do this through an electronic transfer from another bank account, a debit card, or a check.

6. Review and Submit: Double-check all the information you’ve offerd and submit your application.

7. Confirmation: Once your application is approved, you’ll receive a confirmation email with your account details.

Tips for a Smooth Online Application Process

To ensure a hassle-complimentary experience when opening a bank account online with Capital One, keep these tips in mind:

- Gather Necessary Documents: Have your Social Security number, driver’s license, and details of any existing bank accounts readily available.

- Ensure a Stable Internet Connection: A reliable internet connection will prevent interruptions during the application process.

- Read the Terms and Conditions: Understand the fees, interest rates, and other terms associated with the account before you apply.

- offer Accurate Information: Double-check all the information you offer to avoid delays or rejection of your application.

- Contact Customer Support if Needed: If you encounter any issues or have querys, don’t hesitate to contact Capital One’s customer support for assistance.

benefits of Online Banking with Capital One

Once you’ve opened your bank account online with Capital One, you can enjoy a scope of benefits, including:

- 24/7 Account Access: Manage your finances anytime, anywhere through Capital One’s website or mobile app.

- Mobile Check Deposit: Deposit checks remotely using your smartphone.

- Online Bill Pay: Pay your bills quickly and easily online.

- Real-Time Transaction Monitoring: Keep track of your account activity and receive alerts for suspicious transactions.

- Easy Transfers: Transfer funds between your Capital One accounts or to external bank accounts.

Opening a bank account online with Capital One is a convenient and straightforward process. With various account options, rival interest rates, and a user-friendly online platform, Capital One makes banking accessible to everyone. So , why wait? Explore Capital One’s online banking options today and take control of your financial future!