Keeping your business finances in order can feel like a juggling act, especially when it comes to managing your bank accounts and ensuring everything matches up. That’s where QuickBooks Online bank reconciliation comes in ! It’s a crucial process that helps you maintain accurate financial records and avoid costly errors. Let’s dive into how you can master this essential task. Are you ready to learn about QuickBooks, Reconciliation, and Bank Reconciliation ?

Understanding Bank Reconciliation in QuickBooks Online. Bank reconciliation is the process of comparing your internal financial records, specifically your QuickBooks Online account, with your bank statements. The objective is to determine any discrepancies and ensure that both records match. This process helps you catch errors, detect fraud, and maintain accurate financial statements. Why is it so crucial ? Because it gives you a true picture of your business’s financial health !

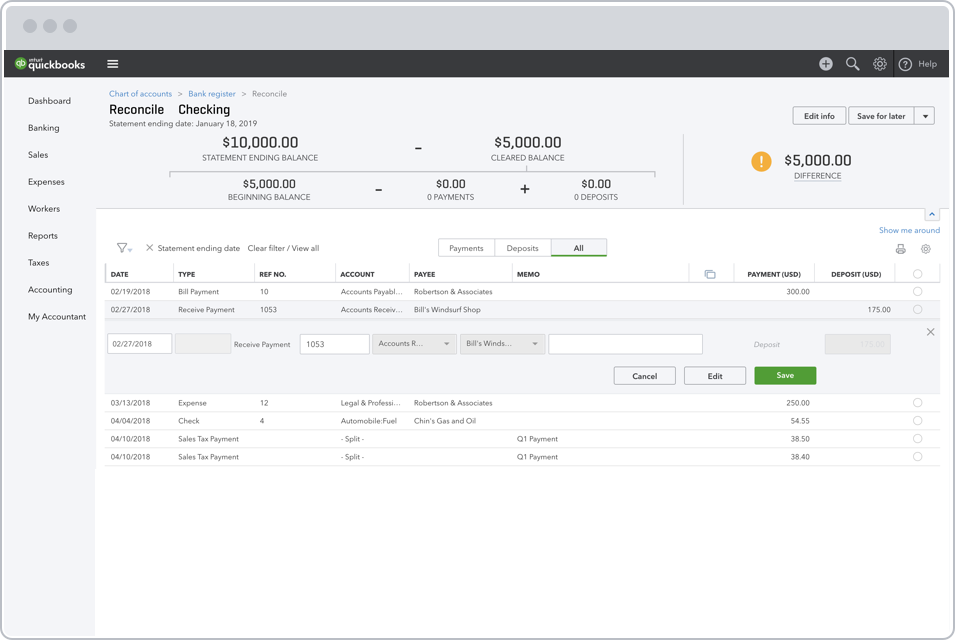

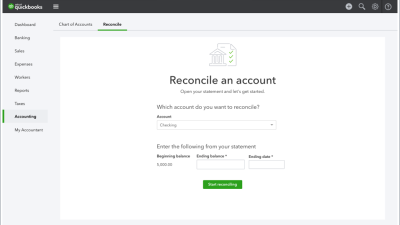

Step-by-Step Guide to Reconciling Your Bank Account in QuickBooks Online. Ready to dive in ? Here’s how to reconcile your bank account in QuickBooks Online: 1. Log in to QuickBooks Online: Access your QuickBooks Online account and navigate to the dashboard. 2. Go to the Reconciliation Tool: Click on the ‘Banking’ tab on the left-hand menu. Then, select ‘Reconcile’. 3. select the Account: select the bank account you want to reconcile from the drop-down menu. 4. Enter Statement Information: Enter the ‘Statement Ending Date’ and the ‘Ending Balance’ as they appear on your bank statement. 5. Start Reconciling: Click the ‘Start Reconciling’ button. QuickBooks Online will display a screen with two sections: ‘Payments and Deposits’ and ‘Bank Statement Balance’. 6. Match Transactions: Review the transactions in QuickBooks Online and compare them to your bank statement. Check off each transaction that matches. If a transaction is missing, you’ll need to add it to QuickBooks Online. 7. Resolve Discrepancies: If there are differences between QuickBooks and your bank statement, investigate and resolve them. Common discrepancies include uncleared checks, deposits in transit, and bank fees. 8. Finish Reconciliation: Once you’ve matched all transactions and resolved any discrepancies, the difference between the ‘Cleared Balance’ and the ‘Statement Ending Balance’ should be zero. If it is, click ‘Finish Now’. Congratulations, you’ve effectively reconciled your bank account !

Common Reconciliation Issues and How to Solve Them. Even with a detailed guide, you might encounter some common issues during reconciliation. Here’s how to tackle them: 1. Missing Transactions: If a transaction appears on your bank statement but not in QuickBooks, add it to QuickBooks. Go to the ‘Banking’ tab, select the appropriate bank account, and click ‘Add Transaction’. 2. Incorrect Amounts: If the amount of a transaction in QuickBooks doesn’t match the bank statement, edit the transaction in QuickBooks to reflect the correct amount. 3. Duplicate Transactions: Sometimes, a transaction might be entered twice in QuickBooks. Delete the duplicate transaction to resolve the issue. 4. Uncleared Checks or Deposits: These are transactions that have been recorded in QuickBooks but haven’t yet cleared the bank. Ensure they are legitimate and wait for them to clear in the next reconciliation period. 5. Bank Fees and Interest: Record any bank fees or interest earned in QuickBooks to keep your records accurate. Use the ‘Add Transaction’ attribute in the ‘Banking’ tab.

Tips for Efficient Bank Reconciliation. To make the reconciliation process smoother and more efficient, consider these tips: 1. Reconcile Regularly: Don’t wait until the end of the year to reconcile your accounts. Monthly reconciliation is ideal for catching errors early. 2. Keep Accurate Records: Ensure all transactions are recorded promptly and accurately in QuickBooks. This reduces the likelihood of discrepancies. 3. Use Bank Feeds: Connect your bank accounts to QuickBooks to automatically import transactions. This saves time and reduces manual data entry errors. 4. Review Unmatched Transactions: Regularly review any unmatched transactions in QuickBooks to determine and resolve issues quickly. 5. Train Your Staff: If you have employees handling your finances, ensure they are properly trained on how to use QuickBooks and perform bank reconciliations.

Related Post : reconcile bank in quickbooks online

Advanced QuickBooks Reconciliation attributes. QuickBooks Online offers some advanced attributes that can streamline the reconciliation process: 1. Auto-Match: QuickBooks can automatically match transactions based on date and amount. Review these matches carefully to ensure accuracy. 2. Reconciliation Reports: Generate reconciliation reports to review past reconciliations and determine any recurring issues. 3. Bank Rules: Set up bank rules to automatically categorize and match transactions based on specific criteria. This can save time and improve accuracy. 4. Accountant Access: Grant your accountant access to your QuickBooks Online account to help with reconciliation and other financial tasks.

Mastering QuickBooks Online bank reconciliation is crucial for maintaining accurate financial records. By following these steps and optimal practices, you can ensure your accounts are balanced and your business finances are in order. Regular reconciliation not only prevents errors but also offers valuable insights into your cash flow and overall financial health. So, take the time to reconcile your bank accounts regularly and enjoy the peace of mind that comes with knowing your finances are accurate and up-to-date !