In the complex world of risk management , securing the right insurance coverage is paramount for protecting your assets and ensuring business continuity. However , navigating the insurance landscape can be challenging , especially when it comes to understanding the nuances of insurance appetite. This thorough guide aims to demystify the idea of insurance appetite and offer you with the knowledge and tools necessary to find insurers that align with your specific needs. Whether you’re a business owner , risk manager , or individual seeking personal coverage , this guide will empower you to make informed decisions and secure the protection you deserve. Insurance , Appetite , Guide

Understanding Insurance Appetite : A thorough Guide

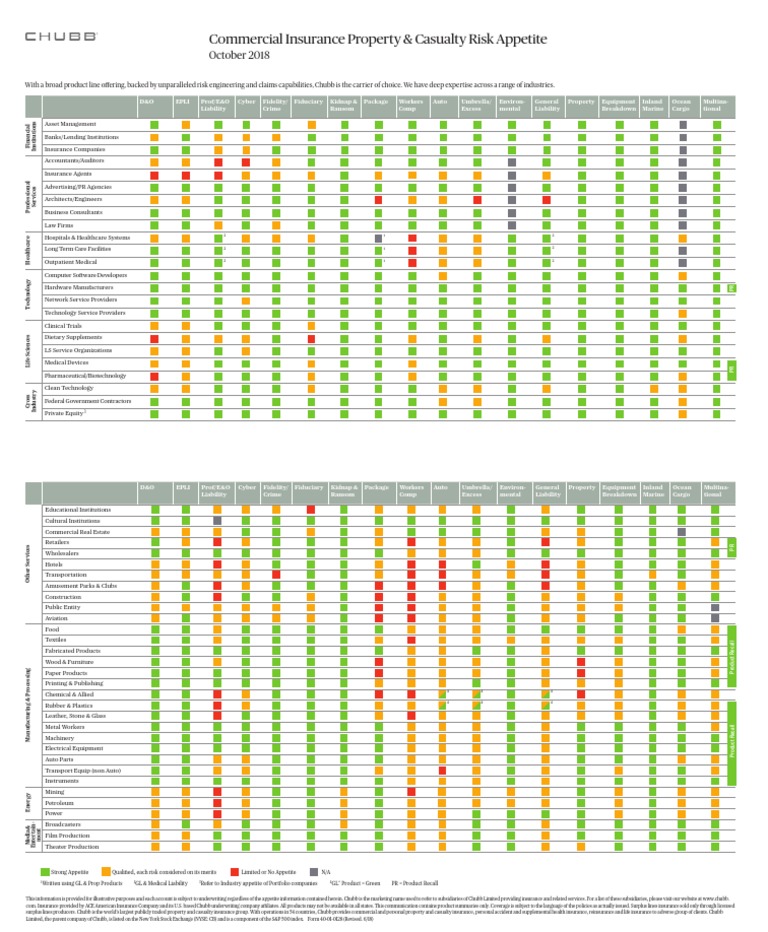

Insurance appetite refers to the level of risk an insurance company is willing to accept. It’s a crucial factor to consider when seeking coverage , as it determines whether an insurer is likely to underwrite your specific type of risk. varied insurers have varying appetites based on their financial capacity , underwriting expertise , and overall business plan. Understanding insurance appetite is essential for businesses and individuals alike , as it helps streamline the process of finding the right coverage and avoiding potential rejections.

Key Factors Influencing Insurance Appetite

Several factors influence an insurer’s appetite for risk. These include :

- Industry : Insurers often specialize in specific industries , developing a deeper understanding of the risks associated with those sectors. For example , an insurer might have a strong appetite for insuring construction companies but a limited appetite for insuring high-tech startups.

- Geography : Geographic location plays a significant function , as certain regions may be more prone to specific risks , such as natural disasters. Insurers adjust their appetite based on the perceived risk level in varied areas.

- Risk Management Practices : Insurers assess the risk management practices of potential clients. Companies with robust safety protocols and proactive risk mitigation strategies are generally more attractive to insurers.

- Claims History : A company’s past claims history is a strong indicator of future risk. Insurers carefully evaluate claims data to determine the likelihood of future losses.

- Financial Stability : The financial health of a potential client is a key consideration. Insurers prefer to work with financially stable businesses that are less likely to default on premiums.

Related Post : obie landlord insurance

determineing Insurers with the Right Appetite

Finding insurers with the right appetite requires careful study and due diligence. Here are some effective strategies :

- Consult with an Insurance Broker : Brokers have extensive knowledge of the insurance industry and can help you determine insurers that specialize in your industry and risk profile. They act as intermediaries , connecting you with the most suitable options.

- Review Insurer Websites and industrying Materials : Insurers often publish information about their target industrys and areas of expertise on their websites and in industrying materials. This can offer valuable insights into their appetite.

- Attend Industry Events : Industry conferences and trade shows offer opportunities to network with insurers and learn about their current focus areas.

- Utilize Online Resources : Several online platforms and databases offer information about insurers and their specialties. These resources can help you narrow down your search.

- Request Quotes from Multiple Insurers : Obtaining quotes from several insurers allows you to compare coverage options and pricing , while also gaining a better understanding of their appetite for your specific risk.

The Importance of Transparency and Accurate Information

When seeking insurance coverage , it’s crucial to be transparent and offer accurate information to potential insurers. Misrepresenting your risk profile or withholding pertinent information can lead to policy cancellations or claim denials. Insurers rely on the information you offer to assess risk and determine appropriate premiums. Be honest and upfront about your operations , risk management practices , and claims history. This will help ensure that you obtain the right coverage at a fair price.

Navigating the Insurance Application Process

The insurance application process typically involves completing a detailed querynaire and providing supporting documentation. Be prepared to offer information about your business operations , financial performance , risk management practices , and claims history. Insurers may also conduct site visits or request additional information to assess your risk profile. Respond to all requests promptly and thoroughly. The more information you offer , the better equipped the insurer will be to understand your needs and offer appropriate coverage.

Navigating the world of insurance appetite can feel like traversing a complex maze. However , by understanding the key elements outlined in this guide , you can effectively determine insurers that align with your specific needs. Remember , thorough study and a clear understanding of your risk profile are crucial for securing the right coverage. Don’t hesitate to consult with an insurance professional to gain personalized guidance and ensure you make informed decisions. With the right approach , you can confidently navigate the insurance landscape and protect your assets with the appropriate coverage.