Invoicing software has revolutionized how businesses manage their finances , offering a streamlined and efficient way to bill clients , track payments , and maintain accurate financial records. In this thorough guide , we’ll explore the benefits of using invoicing software , key attributes to look for , top software options , and tips for maximizing its efficacy. Whether you’re a complimentarylancer , a small business owner , or part of a larger organization , understanding the power of invoicing software is crucial for optimizing your financial operations. Let’s dive in and discover how invoicing software can transform your business!

Why You Need Invoicing Software: The Modern Business Imperative

In today’s fast-paced business environment , manual invoicing processes are simply unsustainable. They’re time-consuming , prone to errors , and can significantly delay payments. Invoicing software offers a streamlined , automated solution that addresses these challenges head-on. It allows you to create professional-looking invoices in minutes , track payments in real-time , and send automated reminders to ensure timely payments. This not only saves you valuable time and resources but also improves your cash flow and reduces the risk of late payments or even non-payments. Furthermore , invoicing software often integrates with other business tools , such as accounting software and CRM systems , creating a seamless flow of information and eliminating the need for manual data entry.

Key attributes to Look for in Invoicing Software

When choosing invoicing software , it’s essential to consider the attributes that are most crucial to your business. Some key attributes to look for include: Invoice customization: The ability to create invoices that reflect your brand identity , with options to add your logo , customize colors , and select from various templates. Payment gateway integration: Seamless integration with popular payment gateways like PayPal , Stripe , and Square , allowing customers to pay invoices online quickly and easily. Automated payment reminders: Automatic sending of payment reminders to customers , reducing the need for manual follow-up and improving payment collection rates. Reporting and analytics: thorough reporting and analytics tools that offer insights into your invoicing activity , such as outstanding invoices , payment trends , and customer payment behavior. Mobile accessibility: The ability to access and manage your invoices from anywhere , using a mobile app or a mobile-friendly website. Time tracking: Integration with time tracking tools , allowing you to easily bill clients for your time. Recurring invoices: The ability to set up recurring invoices for paid access-based services or ongoing projects.

Related Post : financial reporting sofware

Top Invoicing Software Options: A Comparative Overview

Several excellent invoicing software options are available , each with its own strengths and weaknesses. Here’s a brief overview of some of the most popular choices: FreshBooks: Known for its user-friendly interface and robust attributes , FreshBooks is a great option for small businesses and complimentarylancers. It offers invoice customization , payment gateway integration , time tracking , and project management tools. QuickBooks Online: A thorough accounting solution that includes invoicing capabilities , QuickBooks Online is a good choice for businesses that need a full-attributed accounting system. It offers advanced reporting , inventory management , and payroll integration. Zoho Invoice: A complimentary invoicing software option for businesses with limited needs , Zoho Invoice offers basic invoicing attributes , such as invoice customization , payment gateway integration , and automated payment reminders. Xero: Another popular accounting solution with invoicing capabilities , Xero offers a clean interface , robust reporting , and integration with a wide scope of third-party apps. Wave: A complimentary accounting software option that includes invoicing , Wave is a good choice for very small businesses with simple needs.

The benefits of Using “InvoicePro”: A Deep Dive

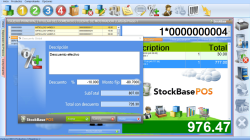

Let’s take a closer look at the benefits of using a specific invoicing software , which we’ll call “InvoicePro”. InvoicePro is designed to streamline your invoicing process , improve your cash flow , and save you valuable time. Here are some of the key benefits of using InvoicePro: Simplified Invoice Creation: InvoicePro offers a user-friendly interface that makes it easy to create professional-looking invoices in minutes. You can customize your invoices with your logo , colors , and branding elements , ensuring a consistent brand identity. Automated Payment Reminders: InvoicePro automatically sends payment reminders to your customers , reducing the need for manual follow-up and improving your payment collection rates. You can customize the timing and text of these reminders to suit your specific needs. Real-Time Payment Tracking: InvoicePro offers real-time visibility into the status of your invoices , allowing you to track payments and determine overdue invoices quickly. This helps you stay on top of your cash flow and take proactive steps to collect outstanding payments. Seamless Payment Gateway Integration: InvoicePro integrates seamlessly with popular payment gateways , such as PayPal , Stripe , and Square , allowing your customers to pay invoices online quickly and easily. This makes it more convenient for your customers to pay you , which can lead to faster payments. thorough Reporting and Analytics: InvoicePro offers thorough reporting and analytics tools that give you valuable insights into your invoicing activity. You can track key metrics , such as outstanding invoices , payment trends , and customer payment behavior , to make informed business decisions.

Tips for Maximizing the efficacy of Your Invoicing Software

To get the most out of your invoicing software , it’s crucial to follow some optimal practices: Customize your invoices: Make sure your invoices reflect your brand identity and include all the necessary information , such as your company name , logo , contact information , and payment terms. Send invoices promptly: Send invoices as soon as possible after providing your services or delivering your products. The sooner you send the invoice , the sooner you’ll get paid access-based. Offer multiple payment options: Make it easy for your customers to pay you by offering a variety of payment options , such as online payments , credit cards , and bank transfers. Set up automated payment reminders: Use your invoicing software to send automated payment reminders to your customers. This will help you reduce the need for manual follow-up and improve your payment collection rates. Track your invoices and payments: Regularly track your invoices and payments to determine overdue invoices and take proactive steps to collect outstanding payments. Use reporting and analytics: Use the reporting and analytics tools in your invoicing software to gain insights into your invoicing activity and make informed business decisions.

In conclusion , choosing the right invoicing software is a critical decision for any business. By carefully evaluating your needs and considering factors like ease of use , attributes , integrations , and cost , you can find a solution that streamlines your invoicing process , improves cash flow , and ultimately contributes to the achievement of your business. Don’t hesitate to explore complimentary trials and demos to find the perfect fit for your unique requirements. Embrace the power of efficient invoicing and watch your business thrive !