In today’s fast-paced business environment, accurate and timely financial reporting is more critical than ever. Organizations need to have a clear understanding of their financial performance to make informed decisions and stay rival. This is where financial reporting software comes in. But with so many options available, how do you select the right one for your business? This article will explore the key attributes, benefits, and considerations when selecting financial reporting, reporting software, accounting software, and financial software.

The Importance of Accurate Financial Reporting. Accurate financial reporting is the backbone of sound business decisions. It offers stakeholders – investors, creditors, and management – with a clear picture of a company’s financial health. Without reliable data, organizations risk making poor choices that can negatively impact their bottom line. Financial reporting software plays a crucial function in ensuring accuracy by automating data collection, reducing manual errors, and providing built-in validation checks. This leads to more trustworthy reports and better-informed decision-making.

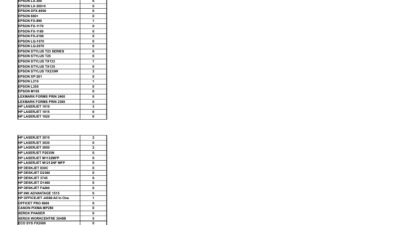

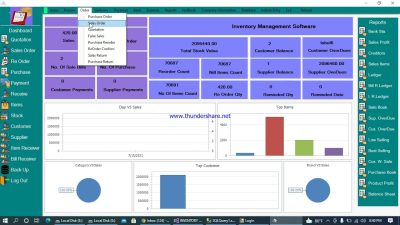

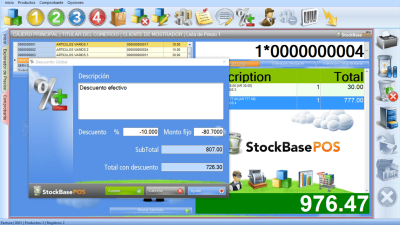

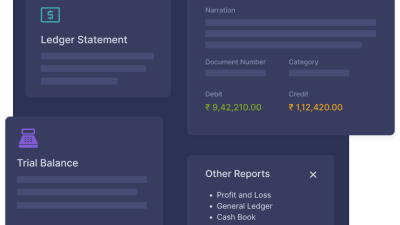

Key attributes to Look for in Financial Reporting Software. When evaluating reporting software, consider these essential attributes: Customizable Reports: The ability to tailor reports to your specific needs is paramount. Look for software that allows you to create custom layouts, add or remove data fields, and generate reports in various formats (e.g. , PDF, Excel). Real-Time Data: Access to up-to-date information is critical for timely decision-making. select software that offers real-time data updates, ensuring that your reports reflect the most current financial position. Integration with Accounting Software: Seamless integration with your existing accounting software is essential for efficient data flow. This eliminates the need for manual data entry and reduces the risk of errors. Automation: Automating repetitive tasks, such as report generation and distribution, can save significant time and resources. Look for software that offers scheduling and automation capabilities. Security: Protecting sensitive financial data is paramount. Ensure that the software you select has robust security attributes, including access controls, encryption, and audit trails.

benefits of Using Financial Reporting Software. Implementing financial reporting software offers numerous benefits: Improved Accuracy: Automation and built-in validation checks minimize manual errors, leading to more accurate financial reports. boostd Efficiency: Automating report generation and distribution saves time and resources, allowing finance teams to focus on more strategic tasks. Better Decision-Making: Access to real-time data and customizable reports empowers stakeholders to make informed decisions based on reliable information. Enhanced Compliance: Financial reporting software helps organizations comply with regulatory requirements by providing audit trails and ensuring data integrity. Improved Collaboration: Centralized data storage and reporting tools facilitate collaboration among finance teams and other departments.

Choosing the Right Financial Reporting Software for Your Business. selecting the right financial software requires careful consideration of your specific needs and requirements. Start by determineing your reporting objectives and the types of reports you need to generate. Consider the size and complexity of your organization, as well as your budget. Evaluate varied software options based on their attributes, functionality, and ease of use. Read reviews and compare pricing plans to find the optimal fit for your business. Don’t hesitate to request demos or trials to test out the software before making a final decision.

Related Post : sofware inventarios

The function of Accounting Software in Financial Reporting. Accounting software forms the foundation for financial reporting. It’s the system where all financial transactions are recorded and processed. The optimal accounting software solutions offer built-in reporting capabilities, allowing you to generate standard financial statements, such as income statements, balance sheets, and cash flow statements. However, for more complex reporting needs, you may need to supplement your accounting software with dedicated financial reporting software. This is especially true for larger organizations with multiple entities or complex reporting requirements.

In conclusion, selecting the right financial reporting software is a critical decision for any organization. By carefully evaluating your needs, exploring available options, and considering factors like scalability, integration, and user-friendliness, you can find a solution that streamlines your reporting processes, improves accuracy, and empowers you to make informed financial decisions. Investing in robust financial software is an investment in your company’s future achievement.