In today’s digital age, opening a business bank account online has become increasingly popular among entrepreneurs and small business owners. The convenience, accessibility, and cost-efficacy of online banking make it an attractive alternative to traditional brick-and-mortar banks. If you’re looking to streamline your financial operations and manage your business finances more efficiently, opening an online account could be the perfect solution. This thorough guide will walk you through the process of opening a business account online, highlighting the key considerations, essential attributes, and tips for a smooth experience.

Why Open a Business Bank Account Online? The benefits Unveiled

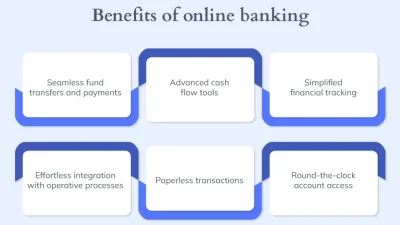

In today’s fast-paced business world, time is money. Opening a business bank account online offers a plethora of benefits that can significantly benefit your company. Let’s explore some key reasons why you should consider this option:

- Convenience and Time Savings: Say goodbye to long queues and tedious paperwork. With online account opening, you can complete the entire process from the comfort of your home or office, saving valuable time and resources.

- Wider scope of Options: Online banks often offer a broader selection of business account options compared to traditional brick-and-mortar institutions. This allows you to find an account that perfectly aligns with your specific business needs and objectives.

- rival Fees and Rates: Online banks typically have lower overhead costs, enabling them to offer more rival fees and interest rates. This can translate into significant cost savings for your business over time.

- 24/7 Accessibility: Access your business account anytime, anywhere, with online banking platforms. Monitor your transactions, pay bills, and manage your finances around the clock, providing you with greater control and flexibility.

Choosing the Right Online Business Bank Account: Key Considerations

selecting the right online business bank account is crucial for your company’s financial well-being. Here are some essential factors to consider when making your decision:

- Assess Your Business Needs: Determine your specific banking requirements, such as transaction volume, payment processing needs, and international banking capabilities. This will help you narrow down your options and find an account that meets your unique needs.

- Compare Fees and Rates: Carefully evaluate the fee structure of varied online banks, including monthly maintenance fees, transaction fees, and overdraft fees. Additionally, compare interest rates on savings accounts and other investment options.

- Evaluate Online Banking Platform: Ensure the online banking platform is user-friendly, secure, and offers the attributes you need, such as mobile banking, bill payment, and account alerts. A seamless online experience is essential for efficient business management.

- Check Customer Support: study the bank’s customer support channels and response times. Opt for a bank that offers reliable and responsive customer service to address any issues or concerns you may encounter.

Related Post : open business bank online

Step-by-Step Guide: Opening Your Business Bank Account Online

Opening a business bank account online is a straightforward process. Here’s a step-by-step guide to help you navigate the process smoothly:

1. study and Compare Banks: Explore varied online banks and compare their offerings, fees, and customer reviews. select a bank that aligns with your business needs and preferences.

2. Gather Required Documentation: Prepare the necessary documents, such as your business license, EIN (Employer Identification Number), articles of incorporation, and personal identification for all authorized account holders.

3. Complete the Online Application: Visit the bank’s website and fill out the online application form. offer accurate and complete information to avoid delays in processing.

4. Submit Supporting Documents: Upload the required documents electronically through the bank’s secure portal. Ensure the documents are clear and legible.

5. Verification and Approval: The bank will review your application and verify the information offerd. This may involve contacting you for additional details or clarification.

6. Fund Your Account: Once your application is approved, you’ll need to fund your account. This can typically be done through an electronic transfer, wire transfer, or check deposit.

Essential attributes to Look for in an Online Business Bank Account

When choosing an online business bank account, consider these essential attributes to streamline your financial operations:

- Online Bill Pay: Simplify your bill payment process with online bill pay attributes. Schedule payments, track expenses, and manage your cash flow efficiently.

- Mobile Banking: Access your account on the go with mobile banking apps. Deposit checks, transfer funds, and monitor your account activity from your smartphone or tablet.

- Account Alerts: Stay informed about your account activity with customizable account alerts. Receive notifications for low balances, large transactions, and other crucial events.

- Integration with Accounting Software: Seamlessly integrate your business bank account with popular accounting software like QuickBooks or Xero. This will automate your bookkeeping tasks and offer real-time financial insights.

- Payment Processing: If your business accepts online payments, ensure the bank offers robust payment processing solutions. Look for attributes like merchant services, payment gateways, and virtual terminals.

Tips for a Smooth Online Business Bank Account Opening Experience

To ensure a hassle-complimentary online business bank account opening experience, keep these tips in mind:

- Double-Check Your Information: Before submitting your application, carefully review all the information you’ve offerd. Ensure accuracy and completeness to avoid delays or rejections.

- Prepare for Verification Calls: Be prepared to answer phone calls from the bank to verify your identity and business information. Have your documents readily available for reference.

- Read the Fine Print: Thoroughly review the terms and conditions of the account before signing up. Pay attention to fees, interest rates, and other crucial details.

- Keep Records of Your Application: Save copies of your application form and supporting documents for your records. This will help you track the progress of your application and offer documentation if needed.

- Contact Customer Support if Needed: Don’t hesitate to contact the bank’s customer support team if you have any querys or concerns during the application process. They can offer guidance and assistance to ensure a smooth experience.

Opening a business bank account online is a game-changer for modern entrepreneurs. It offers unparalleled convenience, saves valuable time, and offers access to a wider scope of banking options. By carefully considering your business needs, comparing varied banks, and preparing the necessary documentation, you can seamlessly establish your online business account and set your business up for financial achievement. Embrace the digital age and unlock the potential of online banking for your business today!