In today’s digital age , managing your business finances has never been easier . Gone are the days of long lines at the bank and cumbersome paperwork . With the rise of online banking , you can now open an easy online bank account from the comfort of your own home or office . This article will explore the benefits of choosing an online bank account for your business account , key attributes to look for , top offerrs , and tips for maximizing your banking experience .

Why select an Easy Online Bank Account for Your Business ?

Running a business is demanding enough without the added hassle of complicated banking procedures . An easy online bank account simplifies your financial management , offering numerous benefits :

- Convenience at Your Fingertips: Manage your finances anytime , anywhere , from your computer or mobile device . No more rushing to the bank during business hours !

- Time Savings: Online banking automates many tasks , such as paying bills , transferring funds , and tracking transactions , complimentarying up your time to focus on core business activities .

- Cost-Effective: Many online business accounts offer lower fees than traditional brick-and-mortar banks , saving you money on monthly maintenance , transaction fees , and more .

- Real-Time Insights: Access up-to-date information on your account balances , transactions , and financial performance , empowering you to make informed decisions .

- Seamless Integration: Many online banking platforms integrate with popular accounting software , streamlining your bookkeeping and tax preparation processes .

Key attributes to Look for in an Online Business Account

When choosing an online business account , consider these essential attributes :

- User-Friendly Interface: The online platform should be intuitive and easy to navigate , even for those with limited technical skills .

- Mobile Banking App: A robust mobile app allows you to manage your finances on the go , deposit checks , and make payments from your smartphone or tablet .

- Bill Payment: Streamline your bill payments by scheduling recurring payments and paying vendors electronically .

- Funds Transfer: Easily transfer funds between your business account and other accounts , both internally and externally .

- Reporting and Analytics: Access detailed reports and analytics to track your cash flow , monitor expenses , and gain insights into your business’s financial health .

- Security Measures: Ensure the online banking platform employs robust security measures , such as multi-factor authentication , encryption , and fraud monitoring , to protect your account from unauthorized access .

Related Post : open business bank online

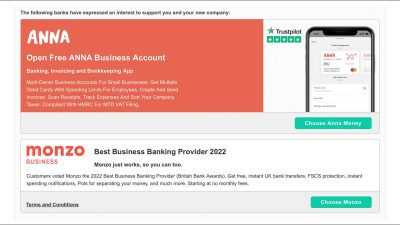

Top offerrs of Easy Online Business Accounts

Several reputable online banks and financial institutions offer easy online business accounts . Here are a few popular options :

- Novo: Known for its sleek interface and focus on small businesses , Novo offers complimentary business checking accounts with no minimum balance requirements .

- Bluevine: Bluevine offers business checking accounts with interest-bearing options and integrates seamlessly with popular accounting software .

- Lili: Designed specifically for complimentarylancers and independent contractors , Lili offers a business checking account with built-in expense tracking and tax preparation tools .

- Mercury: Mercury caters to startups and tech companies , offering business checking accounts with advanced attributes like API access and venture debt financing .

- Brex: Brex offers a thorough financial platform for businesses , including business checking accounts , credit cards , and expense management tools .

How to Open an Easy Online Business Account

Opening an easy online business account is typically a straightforward process . Here’s a general outline of the steps involved :

1. study and Compare: Explore varied online banking options and compare their attributes , fees , and requirements .

2. Gather Required Documents: Collect the necessary documents , such as your business formation documents (e .g ., articles of incorporation , LLC agreement) , employer identification number (EIN) , and personal identification (e .g ., driver’s license , passport) .

3. Complete the Online Application: Fill out the online application form , providing accurate information about your business and its owners .

4. Verify Your Identity: You may be required to verify your identity through online methods , such as uploading a copy of your driver’s license or participating in a video call .

5. Fund Your Account: Once your application is approved , you’ll need to fund your account by transferring funds from another bank account or making a deposit .

6. Start Banking Online: After your account is funded , you can start using the online banking platform to manage your finances , pay bills , and track transactions .

Tips for Maximizing Your Online Banking Experience

To make the most of your easy online business account , consider these tips :

- Set Up Alerts and Notifications: Configure alerts to notify you of crucial account activity , such as low balances , large transactions , or suspicious activity .

- Reconcile Your Accounts Regularly: Reconcile your online bank statements with your accounting records to ensure accuracy and determine any discrepancies .

- Take benefit of Automation: Automate recurring tasks , such as bill payments and fund transfers , to save time and reduce the risk of errors .

- Explore Integrations: Integrate your online banking platform with other business tools , such as accounting software , payment processors , and CRM systems , to streamline your workflows .

- Stay Informed About Security: Keep up-to-date on the latest security threats and optimal practices for protecting your online banking account .

In conclusion , opening an easy online bank account for your business is a smart move in today’s fast-paced world . It offers convenience , accessibility , and often , cost savings . By carefully considering your business needs and comparing varied options , you can find the perfect banking solution to support your growth and achievement . Embrace the digital age and unlock the potential of online banking for your business !