In today’s digital age, online banking has become an essential part of managing our finances. With the convenience of accessing your accounts from anywhere, it’s no surprise that more and more people are choosing to open bank accounts online. If you’re considering joining the digital banking revolution, you might be wondering, “Can I open a Truist bank account online?” The answer is a resounding yes! Truist , a leading financial institution, offers a seamless online account opening process, making it easier than ever to manage your money. Let’s dive into the details of how you can open a Truist account online and what benefits you can expect from Truist online banking .

Understanding Truist Bank and Its Online Presence

Truist is a major financial institution formed through the merger of BB&T and SunTrust. Known for its wide scope of banking services, Truist offers everything from basic checking and savings accounts to loans, investments, and wealth management solutions. One of the key facets of Truist’s service is its robust online banking platform, designed to offer customers with convenient access to their accounts and banking services. This platform is crucial for those who prefer to manage their finances digitally. Truist online banking aims to be user-friendly and thorough, catering to a diverse customer base.

Can You Open a Truist Bank Account Online? Yes, Here’s How

Yes , you absolutely can open a Truist bank account online! Truist has invested significantly in its digital infrastructure, making it easy for new customers to open accounts from the comfort of their homes. The process is designed to be straightforward and efficient, allowing you to quickly set up your account and start managing your finances. Here’s a step-by-step guide to opening a Truist account online:

Related Post : wells fargo setup online banking

1. Visit the Truist Website: Go to the official Truist website.

2. select Your Account: Browse the available account options, such as checking accounts, savings accounts, or money industry accounts. select the one that optimal fits your needs.

3. Complete the Application: Fill out the online application form with accurate personal information, including your name, address, date of birth, Social Security number, and contact details.

4. Verify Your Identity: You may need to verify your identity by providing additional documentation, such as a copy of your driver’s license or passport.

5. Fund Your Account: Make an initial deposit to activate your account. Truist typically allows you to transfer funds electronically from another bank account or make a deposit using a debit or credit card.

6. Review and Submit: Double-check all the information you’ve entered and submit your application.

Once your application is processed and approved, you’ll receive confirmation and access to your new Truist account. You can then start using Truist online banking to manage your funds, pay bills, and more.

benefits of Opening a Truist Account Online

Opening a Truist account online comes with several benefits:

- Convenience: You can apply for an account anytime, anywhere, without visiting a branch.

- Speed: The online application process is typically faster than opening an account in person.

- Accessibility: Manage your account 24/7 through Truist online banking and mobile app.

- Account Options: Truist offers a variety of accounts to suit varied financial needs, all accessible online.

- User-Friendly Interface: Truist online banking is designed to be easy to navigate, even for those who are not tech-savvy.

attributes of Truist Online Banking

Truist online banking is packed with attributes designed to make managing your money easier. Here are some of the key attributes you can expect:

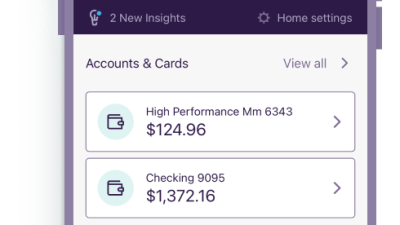

- Account Management: View your account balances, transaction history, and statements.

- Bill Pay: Pay your bills online quickly and securely.

- Transfers: Transfer funds between your Truist accounts or to external accounts.

- Mobile Banking: Access your account on the go with the Truist mobile app.

- Alerts: Set up alerts to notify you of crucial account activity, such as low balances or large transactions.

- eStatements: Receive your bank statements electronically, reducing paper clutter and enhancing security.

- Personalized Settings: Customize your online banking experience to suit your preferences.

Tips for a Smooth Online Account Opening Experience

To ensure a smooth and hassle-complimentary experience when opening a Truist account online, keep these tips in mind:

- Gather Necessary Information: Before you start the application, have all your personal information and identification documents ready.

- Ensure a Stable Internet Connection: A reliable internet connection will prevent interruptions during the application process.

- Read the Terms and Conditions: Understand the terms and conditions of the account before you agree to them.

- Contact Customer Support: If you encounter any issues or have querys, don’t hesitate to contact Truist customer support for assistance.

- Secure Your Account: Once your account is open, set up strong passwords and enable two-factor authentication for added security.

Opening a Truist account online offers a convenient and efficient way to manage your finances. With a straightforward application process, various account options, and robust online banking attributes, Truist makes it easy to handle your banking needs from anywhere. Whether you’re looking for a simple checking account or a more thorough banking solution, Truist’s online platform offers the tools and resources you need to succeed. So , why wait? Explore Truist’s online banking options today and take control of your financial future!