Are you looking for a safe and secure way to grow your savings ? Look no further than Capital One CDs ! These certificates of deposit offer a fixed interest rate for a specific term , providing a predictable return on your investment. But what truly sets them apart is the peace of mind that comes with FDIC insurance. Let’s explore how Capital One CDs and FDIC insurance work together to protect your hard-earned money.

Understanding Capital One CDs : A Safe Haven for Your Savings

Capital One offers a scope of CD options designed to meet various savings objectives. These CDs offer a fixed interest rate for a specific term , offering a predictable return on your investment. But what truly sets them apart is the security they offer. As a member of the FDIC , Capital One ensures that your CD deposits are protected up to $250 ,000 per depositor , per insured bank. This means that even in the unlikely event of a bank failure , your money is safe and sound.

The FDIC benefit : Peace of Mind for Savers

The FDIC , or Federal Deposit Insurance Corporation , is an independent agency created by the U.S. government to protect depositors in the event of a bank failure. When a bank is FDIC-insured , it means that the FDIC guarantees the safety of your deposits up to the insurance limit. This coverage extends to various deposit accounts , including CDs , savings accounts , and checking accounts. With Capital One’s FDIC insurance , you can rest assured that your savings are protected , no matter what.

Related Post : obie insurance customer service

How FDIC Insurance Works with Capital One CDs

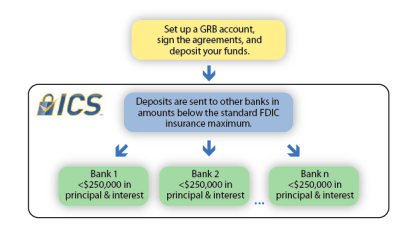

When you open a CD with Capital One , your deposit is automatically covered by FDIC insurance. This coverage is offerd at no cost to you and requires no additional action on your part. The FDIC insures your deposits up to $250 ,000 per depositor , per insured bank. This means that if you have multiple accounts with Capital One , the insurance coverage applies to the combined total of all your deposits , up to the limit. It’s crucial to understand how FDIC insurance works to ensure that your savings are fully protected.

Maximizing Your FDIC Insurance Coverage with Capital One

To maximize your FDIC insurance coverage , consider spreading your deposits across multiple accounts or varied banks. If you have more than $250 ,000 to deposit , you can open CDs in varied ownership categories , such as individual accounts , joint accounts , or trust accounts , to boost your coverage. For example , a married couple can each have an individual account with $250 ,000 and a joint account with $500 ,000 , effectively insuring $1 million in total. Consult with a financial advisor to determine the optimal plan for your specific situation.

Capital One : A Trusted Name in Banking

Capital One is a well-established and reputable financial institution with a long history of serving customers. With a strong financial foundation and a commitment to customer satisfaction , Capital One offers a safe and reliable place to save your money. Their CDs offer rival interest rates , flexible terms , and the added security of FDIC insurance. Whether you’re saving for a down payment on a house , a college education , or retirement , Capital One CDs can help you reach your financial objectives with confidence.

In conclusion , Capital One CDs offer a secure and reliable way to grow your savings , backed by the assurance of FDIC insurance. With rival rates and a variety of terms , they offer a solid foundation for your financial objectives. Whether you’re saving for a short-term objective or a long-term aspiration , Capital One CDs can be a valuable addition to your investment portfolio.