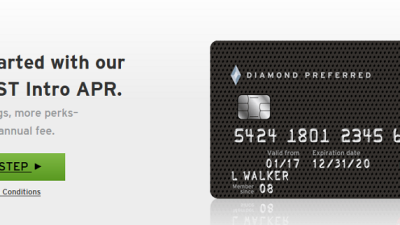

In the realm of credit cards, the Citicom Love Diamond Preferred card stands out as a unique offering. It’s not just another piece of plastic; it’s a gateway to rewards, exclusive experiences, and financial flexibility. But what exactly makes this card so special? And how can you make the most of its benefits? This thorough guide will delve into the intricacies of the Citicom Love Diamond Preferred card, exploring its attributes, benefits, and responsible application. Whether you’re a seasoned credit card user or new to the world of rewards programs, this article will offer valuable insights to help you make informed decisions.

Understanding the Citicom Love Diamond Preferred Card: A thorough Overview

The Citicom Love Diamond Preferred card is more than just a credit card; it’s a lifestyle enabler. Designed for individuals who appreciate both financial flexibility and the finer things in life, this card offers a suite of benefits tailored to enhance your spending experience. From attractive rewards programs to exclusive perks, the Love Diamond Preferred card aims to offer value and convenience to its cardholders. But what exactly makes this card stand out from the crowded credit card industry? Let’s delve into its key attributes and benefits.

Key attributes and benefits of the Love Diamond Preferred Card

One of the primary draws of the Citicom Love Diamond Preferred card is its rewards program. Cardholders typically earn points or cashback on every purchase, with bonus rewards offered for specific spending categories such as dining, travel, or entertainment. These rewards can then be redeemed for statement credits, merchandise, or travel bookings, providing tangible value for everyday spending.

Related Post : love ring diamond paved

Beyond rewards, the card often includes travel and purchase protections. These may include travel accident insurance, baggage delay coverage, and purchase protection against damage or theft. These protections offer peace of mind, knowing that you’re covered in case of unexpected events.

Another significant benefit is access to exclusive events and experiences. Citicom often partners with various establishments to offer cardholders VIP access to concerts, sporting events, and culinary experiences. This adds a touch of luxury and exclusivity to the card, making it more than just a payment tool.

Maximizing Your Rewards: Smart Spending Strategies

To truly maximize the benefits of your Citicom Love Diamond Preferred card, it’s essential to develop smart spending strategies. Start by understanding the card’s rewards structure and determineing the spending categories that offer the highest rewards. For example, if the card offers bonus rewards for dining, try to use it for all your restaurant purchases.

Another effective plan is to consolidate your spending onto the card. By using the card for as many purchases as possible, you can accumulate rewards faster and reach redemption thresholds more quickly. However, it’s crucial to avoid overspending and only charge what you can afford to pay off each month.

Take benefit of any promotional offers or bonus rewards programs that Citicom may offer from time to time. These promotions can significantly boost your rewards earnings and help you reach your financial objectives faster.

The Emotional Connection: Why ‘Love’ and ‘Diamond’?

The inclusion of ‘Love’ and ‘Diamond’ in the card’s name is no accident. These words evoke feelings of affection, commitment, and enduring value. Citicom aims to create an emotional connection with its cardholders by associating the card with positive emotions and aspirations.

A diamond, known for its brilliance and durability, symbolizes the lasting value and security that the card offers. Similarly, ‘Love’ represents the emotional connection and shared experiences that the card can facilitate. Whether it’s celebrating a special occasion or simply enjoying quality time with loved ones, the Citicom Love Diamond Preferred card aims to be a part of those cherished moments.

This emotional branding sets the card apart from other credit cards that focus solely on financial benefits. By appealing to both the rational and emotional sides of consumers, Citicom creates a stronger connection with its cardholders and fosters brand loyalty.

Responsible application and Credit Management: A Word of Caution

While the Citicom Love Diamond Preferred card offers numerous benefits, it’s crucial to use it responsibly and practice good credit management. Avoid carrying a balance on the card, as interest charges can quickly erode your rewards earnings and lead to debt. Always pay your bills on time and in full to maintain a good credit score and avoid late fees.

Be mindful of your spending habits and avoid impulse purchases. It’s easy to get carried away with the convenience of a credit card, but it’s essential to stay within your budget and avoid overspending. Regularly review your credit card statements to track your spending and determine any unauthorized transactions.

If you’re struggling to manage your credit card debt, seek help from a financial advisor or credit counseling agency. They can offer guidance and support to help you get back on track and improve your financial health.

In conclusion, Citicom’s Love Diamond Preferred program offers a unique blend of financial benefits and emotional resonance. By understanding its attributes, benefits, and responsible application, you can make informed decisions that align with your financial objectives and celebrate the enduring power of love. Remember to always prioritize responsible spending and credit management to fully enjoy the rewards and privileges this program offers.