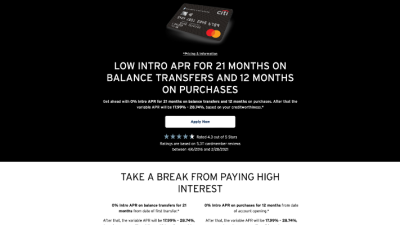

Are you looking for a credit card that can help you tackle debt or finance a large purchase? The Citi Diamond Preferred card might be the answer. Known for its lengthy 0% APR period, this card offers a compelling solution for those seeking to manage their finances more effectively. In this thorough guide, we’ll delve into the details of the Citi Diamond Preferred, exploring its attributes, benefits, and potential drawbacks to help you make an informed decision about whether it’s the right card for you.

Understanding the Citi Diamond Preferred Card

Key attributes and benefits of the Citi Diamond Preferred

Who Should Apply for the Citi Diamond Preferred?

How to Maximize the benefits of Your Citi Diamond Preferred Card

Related Post : citi diamond preferred card requirements

Potential Drawbacks and Considerations

In conclusion, the Citi Diamond Preferred card can be a valuable tool for managing and reducing debt. Its standout attribute, the extended 0% APR period, offers a significant benefit for those looking to consolidate balances or finance large purchases. However, it’s crucial to weigh the benefits against the potential drawbacks, such as the lack of rewards and the importance of responsible credit management. By carefully considering your financial situation and spending habits, you can determine whether the Citi Diamond Preferred card is the right choice for you. Always remember to pay your balances on time and within the promotional period to avoid accruing interest and maintain a healthy credit score.