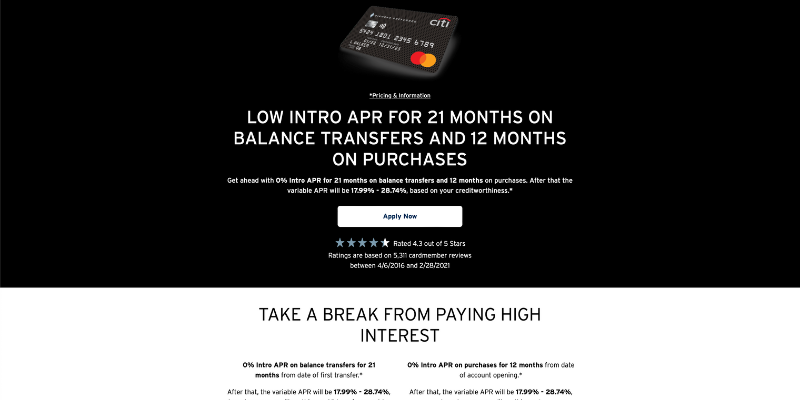

The Citi Diamond Preferred card is often touted for its attractive balance transfer offers, particularly its extended 0% introductory APR period. But before you jump on the chance to consolidate your high-interest debt, it’s crucial to understand the ins and outs of the Citi Diamond Preferred balance transfer limit. This article will delve into the specifics, providing you with a thorough guide to make informed decisions and potentially save money on interest charges.

Understanding the Citi Diamond Preferred Card

What is a Balance Transfer?

Citi Diamond Preferred Balance Transfer Limit: Key Considerations

Maximizing Your Balance Transfer plan with Citi

Related Post : compare citi simplicity and diamond preferred

Potential Pitfalls and How to Avoid Them

In conclusion, understanding the Citi Diamond Preferred balance transfer limit is crucial for effectively managing your debt. By carefully planning your balance transfer plan and being aware of the fees and terms involved, you can leverage this card to potentially save money on interest and accelerate your debt repayment journey. Always remember to review the specific terms and conditions of your offer and make informed decisions based on your financial situation.