In today’s digital age, managing your business finances has never been easier. One of the most significant advancements is the ability to apply online for a business bank account. This convenient option saves time, reduces paperwork, and offers access to a scope of online banking tools that can streamline your financial operations. Whether you’re a startup or an established enterprise, opening a business account is a crucial step in managing your finances effectively. Let’s explore the benefits of applying online and how to make the process as smooth as possible. A business account is essential for separating your personal and business finances, establishing credibility with customers and vendors, and simplifying tax preparation. With online banking, you can easily manage your account from anywhere, at any time. Apply online today!

Why Apply Online for a Business Bank Account?

In today’s fast-paced business environment, time is of the essence. Applying for a business account online eliminates the need for time-consuming branch visits and paperwork. You can complete the entire application process from the comfort of your office or home, at a time that suits you optimal. This convenience allows you to focus on what truly matters: growing your business. Moreover, online applications often come with faster processing times, enabling you to access your account and start managing your finances sooner.

Key Considerations Before You Apply Online

Before you dive into the application process, it’s crucial to assess your business’s specific needs. Consider the types of transactions you’ll be making, the volume of transactions you anticipate, and any specific attributes you require, such as international transfers or merchant services. study varied banks and compare their offerings, fees, and online banking platforms. Look for a bank that aligns with your business objectives and offers the tools you need to manage your finances effectively. Don’t hesitate to read reviews and seek recommendations from other business owners.

Related Post : open business bank online

Essential Documents for Your Online Application

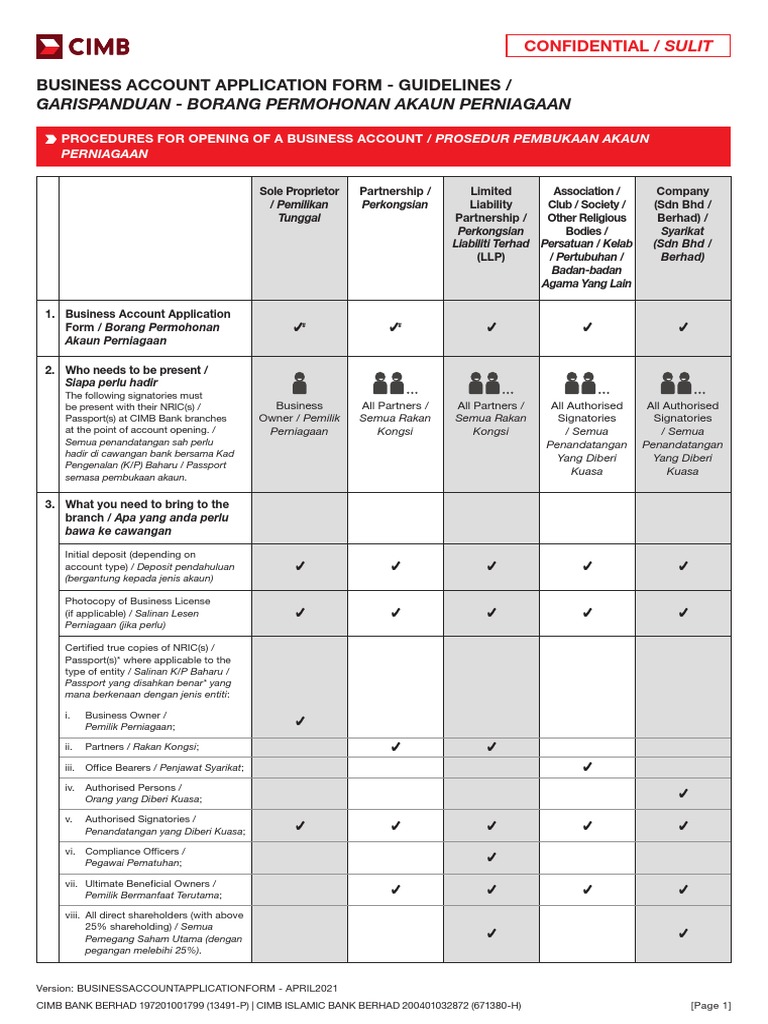

To ensure a smooth and efficient application process, gather all the necessary documents beforehand. Typically, you’ll need your business’s legal name, address, and Employer Identification Number (EIN). You’ll also need to offer information about your business structure, such as whether it’s a sole proprietorship, partnership, LLC, or corporation. Be prepared to submit copies of your business license, articles of incorporation (if applicable), and personal identification documents for all authorized signatories. Having these documents readily available will expedite the application process and minimize potential delays.

Step-by-Step Guide to Applying Online

The online application process generally involves the following steps:

1. Visit the bank’s website and navigate to the business account section.

2. select the type of business account that optimal suits your needs.

3. Complete the online application form, providing accurate and up-to-date information.

4. Upload the required documents in the specified format.

5. Review your application carefully before submitting it.

6. You may be required to verify your identity through a secure online portal.

7. Once your application is submitted, you’ll receive a confirmation email and a timeline for the review process.

Throughout the process, ensure you have a stable internet connection and follow the bank’s instructions carefully. If you encounter any difficulties, don’t hesitate to contact the bank’s customer support for assistance.

Maximizing Your Online Banking Experience

Once your business account is approved and you have access to online banking, take the time to explore the platform’s attributes and functionalities. Familiarize yourself with tools for managing transactions, paying bills, transferring funds, and monitoring your account balance. Set up alerts and notifications to stay informed about crucial account activity. Consider integrating your online banking with accounting software to streamline your financial management processes. By leveraging the power of online banking, you can gain greater control over your business finances and make more informed decisions.

Opening a business bank account online is a game-changer for modern entrepreneurs. It offers unparalleled convenience, saves valuable time, and offers access to a suite of online banking tools that can streamline your financial operations. By carefully considering your business needs, comparing varied banks, and preparing the necessary documentation, you can effectively apply online and unlock the benefits of a dedicated business account. Embrace the digital age and empower your business with the ease and efficiency of online banking!