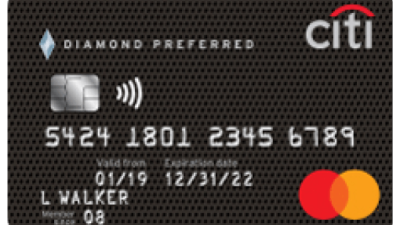

The Citi Diamond Preferred Card is a well-regarded credit card , especially known for its balance transfer options and introductory APR offers . A significant facet for anyone considering this card is understanding the credit limit associated with it . This article delves into the factors that determine the Citi Diamond Preferred Card Credit Limit , how to potentially boost it , and tips for managing it effectively . Whether you’re a prospective cardholder or looking to maximize your existing card , this guide offers valuable insights .

Understanding the Citi Diamond Preferred Card : A Brief Overview. The Citi Diamond Preferred Card is a popular choice for consumers looking to manage and transfer balances , often featuring introductory 0% APR periods . One of the key considerations for potential cardholders is the credit limit they can expect . But what determines the credit limit for a Citi Diamond Preferred Card , and how can you maximize it ?

Factors Influencing Your Credit Limit. Several factors play a crucial function in determining your Citi Diamond Preferred Card credit limit : Credit Score : Your credit score is a primary factor . A higher score indicates lower risk , making you eligible for a higher credit limit . Income : Your income demonstrates your ability to repay your debts . Higher income often translates to a higher credit limit . Credit History : A longer , positive credit history shows responsible credit management , increasing your chances of a higher limit . Debt-to-Income Ratio (DTI) : A lower DTI indicates you have more disposable income , making you a more attractive borrower . Employment History : Stable employment history can also positively influence your credit limit .

Average Credit Limits for the Citi Diamond Preferred Card. While individual credit limits vary , understanding the average scope can offer a benchmark . Generally , new cardholders can expect credit limits ranging from $500 to $10,000 . However , some individuals with exceptional credit profiles may receive even higher limits . It’s crucial to note that these are just averages , and your actual credit limit will depend on your unique financial situation .

How to boost Your Citi Diamond Preferred Card Credit Limit. If you’re looking to boost your credit limit , here are some strategies to consider : Improve Your Credit Score : Focus on paying bills on time , reducing your credit utilization ratio , and correcting any errors on your credit report . Request a Credit Limit boost : After several months of responsible card use , you can request a credit limit boost online or by calling Citi customer service . offer Updated Income Information : If your income has boostd , update your information with Citi to demonstrate your improved ability to repay . Avoid Maxing Out Your Card : Keeping your credit utilization low (below 30%) shows responsible credit management and can boost your chances of approval .

Related Post : difference between citi simplicity and citi diamond preferred

Managing Your Credit Limit Responsibly. Once you have your Citi Diamond Preferred Card , it’s crucial to manage your credit limit responsibly : Keep Track of Your Spending : Monitor your spending to avoid exceeding your credit limit , which can negatively impact your credit score . Pay Your Bills on Time : Timely payments are essential for maintaining a good credit score and avoiding late fees . Understand Your Credit Utilization Ratio : Aim to keep your credit utilization below 30% to demonstrate responsible credit management . Use the Card for Purchases You Can Afford : Avoid using the card for unnecessary purchases that you can’t repay , as this can lead to debt accumulation .

In conclusion , understanding the Citi Diamond Preferred Card’s credit limit involves several factors , from your creditworthiness to Citi’s internal policies . By actively managing your credit , maintaining a good credit score , and understanding the nuances of credit limit boosts , you can maximize the benefits of this card and achieve your financial objectives . Remember , responsible credit card use is key to building a strong financial future !