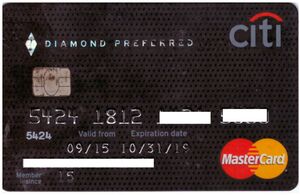

Looking for a credit card that can help you tackle debt? The Citibank Diamond Preferred Credit Card might be worth considering. This card is known for its long introductory APR on balance transfers, making it an attractive option for those looking to consolidate high-interest debt. But is it the right card for you? Let’s explore the pros and cons of the Citibank Diamond Preferred Credit Card and see if it fits your needs.

Unveiling the Citibank Diamond Preferred Credit Card: A thorough Look

So, you’re on the hunt for a new credit card? Maybe you’re drowning in high-interest debt and looking for a lifeline? The Citibank Diamond Preferred Credit Card might just be the answer you’ve been searching for. Let’s dive deep and see what this card has to offer, shall we?

The Allure of the Long Introductory APR: A Debt-Slayer’s Dream

The main draw of the Citibank Diamond Preferred Credit Card is undoubtedly its lengthy introductory APR on balance transfers. We’re talking about a significant period where you can transfer your high-interest debt and pay it down without accruing any additional interest charges. This can be a game-changer for those looking to consolidate debt and save money on interest payments. But remember, this introductory period is temporary, so plan your repayment plan accordingly!

Related Post : compare citi simplicity and diamond preferred

Decoding the Fine Print: Fees, Rates, and Other Considerations

Now, before you jump in headfirst, let’s talk about the not-so-glamorous stuff: fees and rates. While the introductory APR is enticing, it’s crucial to understand the terms and conditions. Pay close attention to the balance transfer fees, which can eat into your savings if you’re not careful. Also, be aware of the purchase APR, which will kick in after the introductory period ends. And of course , late payment fees and other charges can quickly add up if you’re not responsible with your credit card application.

Citibank’s Diamond Preferred vs. the Competition: How Does It Stack Up?

In the crowded world of credit cards, the Citibank Diamond Preferred Credit Card faces stiff competition. Other cards may offer rewards programs, travel perks, or lower ongoing APRs. It’s essential to compare your options and select a card that aligns with your specific needs and spending habits. Consider factors such as your credit score, spending patterns, and debt repayment objectives when making your decision. Don’t just settle for the first card you see!

Maximizing the benefits: Tips for Responsible Credit Card Use

Okay, so you’ve decided the Citibank Diamond Preferred Credit Card is the right choice for you. Now what? It’s crucial to use your credit card responsibly to avoid falling into debt and damaging your credit score. Always pay your bills on time and in full, if possible. Avoid overspending and exceeding your credit limit. And regularly monitor your credit report for any errors or fraudulent activity. Remember, a credit card is a powerful tool, but it can also be a dangerous weapon if misused.

In conclusion, the Citibank Diamond Preferred Credit Card stands out as a strong contender for individuals seeking a balance transfer card with a lengthy introductory APR period. Its lack of rewards and potential for balance transfer fees should be carefully considered against the benefits of its promotional offer. Always compare your options and assess your spending habits to determine if this card aligns with your financial objectives. Remember to use credit responsibly and pay your balances on time to avoid accumulating debt and maintain a healthy credit score.