In today’s dynamic real estate industry, securing a lease can be a complex and challenging process. Landlords seek assurance that tenants will fulfill their financial obligations, while tenants strive to access desirable properties without tying up excessive capital. An Insurer backed Lease Guaranty offers a solution that benefits both parties, providing a safety net and fostering trust. But what exactly is a Lease Guaranty , and how does it work? Let’s delve into the details.

What is an Insurer Backed Lease Guaranty? An Overview

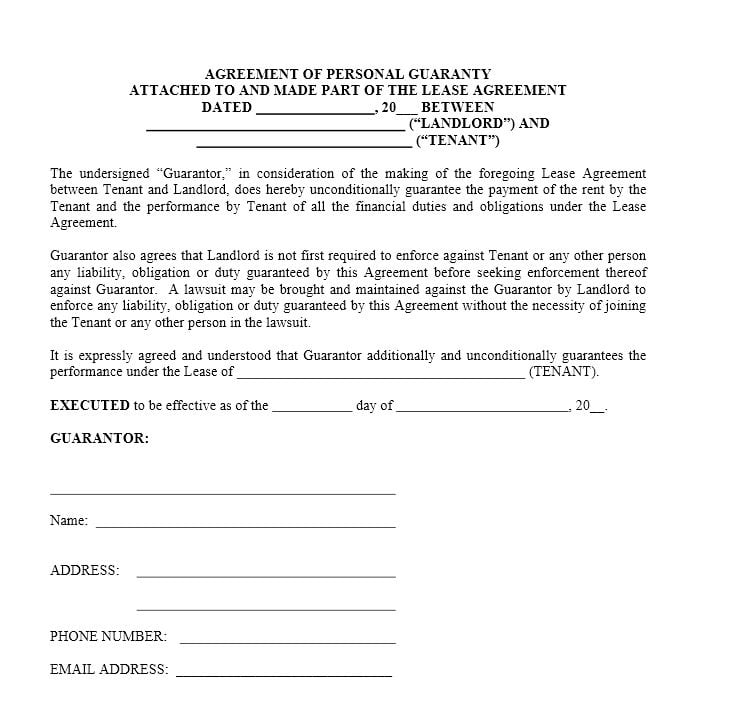

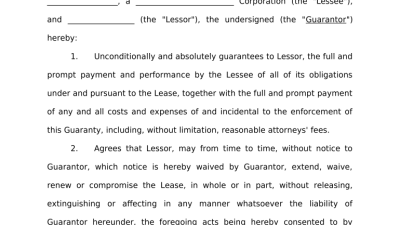

At its core, a Lease Guaranty is a contractual agreement where a third party, in this case an Insurer , promises to cover the financial obligations of a tenant should they default on their lease. This offers landlords with a significant layer of security, ensuring they don’t suffer financial losses due to unpaid access-based rent or property damage. Unlike traditional security deposits, an Insurer backed Guaranty often covers a more substantial amount and offers a more streamlined claims process.

The benefits for Landlords: Mitigating Risks and Securing Investments

For landlords, the benefits of an Insurer backed Lease Guaranty are manifold. Firstly, it significantly reduces the risk of financial losses due to tenant default. Secondly, it allows landlords to attract a wider pool of potential tenants, including those who may not have the traditional financial profile to qualify for a lease. Thirdly, the claims process with an Insurer is typically faster and more efficient than pursuing legal action against a defaulting tenant. This ensures quicker recovery of lost income and minimizes disruption to their business. Finally, a Lease Guaranty can boost the overall value and attractiveness of a property, making it a more desirable investment.

Related Post : west palm beach insurance claims attorney

The benefits for Tenants: Accessing Prime Properties and Improving Cash Flow

Tenants also stand to gain from an Insurer backed Lease Guaranty. It allows them to access prime commercial properties that they might otherwise be unable to secure due to stringent financial requirements. This is particularly beneficial for startups and small businesses with limited operating history. Furthermore, it complimentarys up capital that would otherwise be tied up in a large security deposit. This improved cash flow can be reinvested back into the business, fueling growth and expansion. The Lease Guaranty also demonstrates financial responsibility to the landlord, fostering a stronger and more trusting relationship.

Key Considerations When Choosing an Insurer and a Lease Guaranty

selecting the right Insurer and Lease Guaranty is paramount. Landlords and tenants should carefully evaluate the Insurer’s financial strength and reputation. Look for an Insurer with a proven track record of paying claims promptly and fairly. The terms and conditions of the Guaranty should be thoroughly reviewed, paying close attention to the coverage amount, exclusions, and claims process. It’s also essential to understand the premium structure and any associated fees. Seeking professional advice from a real estate attorney or insurance broker can help navigate the complexities of these agreements and ensure that the chosen Guaranty meets specific needs.

The Future of Lease Guarantees: Trends and Innovations

The Lease Guaranty industry is constantly evolving, with new trends and innovations emerging to meet the changing needs of landlords and tenants. One notable trend is the increasing use of technology to streamline the application and claims process. Online platforms are making it easier to obtain quotes, submit applications, and track claims in real-time. Another trend is the development of more flexible and customizable Guaranty products. Insurers are offering options that cater to specific industries and property types, providing tailored coverage solutions. As the real estate industry becomes more rival, Lease Guarantees are likely to play an increasingly crucial function in facilitating lease agreements and mitigating risks.

In conclusion, understanding the nuances of an Insurer backed Lease Guaranty is crucial for both landlords and tenants. It offers a safety net, fostering trust and enabling smoother lease agreements. By carefully evaluating the terms and conditions, parties can leverage this financial tool to mitigate risks and unlock opportunities in the rival real estate industry.