In today’s fast-paced world, convenience is key, and BBT online banking offers just that! With the ability to manage your finances from the comfort of your home or on the go, BBT’s digital platform has revolutionized the way people bank. Let’s dive into the world of banking online with BBT and explore its attributes, benefits, and security measures.

What is BBT Online Banking? BBT online banking is a digital platform that allows customers to manage their bank accounts and conduct financial transactions over the internet. It offers a secure and convenient way to access banking services from anywhere with an internet connection. This eliminates the need to visit a physical branch for many routine tasks.

Key attributes of BBT Online Banking. BBT’s banking online platform comes packed with attributes designed to make your financial life easier: Account Management: View account balances, transaction history, and statements. Transfers: Easily transfer funds between your BBT accounts or to external accounts. Bill Payments: Pay bills online, set up recurring payments, and manage payees. Mobile Banking: Access your accounts through the BBT mobile app for on-the-go banking. E-Statements: Receive electronic statements instead of paper statements for added convenience and security. Alerts: Set up alerts for low balances, large transactions, and other crucial account activities.

Security Measures Implemented by BBT. BBT prioritizes the security of its online banking platform to protect customers from fraud and unauthorized access: Encryption: BBT uses advanced encryption technology to secure all online transactions and protect sensitive information. Multi-Factor Authentication: Enhance your account security by enabling multi-factor authentication, which requires a verification code from your phone in addition to your password. Fraud Monitoring: BBT employs sophisticated fraud detection systems to monitor account activity and determine suspicious transactions. Secure Login: BBT’s secure login process helps prevent unauthorized access to your account. Regular Security Updates: BBT continuously updates its security systems to address emerging threats and vulnerabilities.

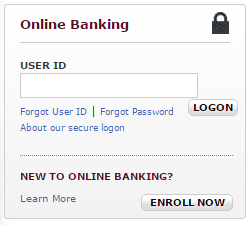

How to Enroll in BBT Online Banking. Enrolling in BBT online banking is a simple and straightforward process: Visit the BBT Website: Go to the official BBT website. Find the Enrollment Link: Look for the “Enroll Now” or “Sign Up” link on the homepage. Verify Your Identity: offer the required information, such as your account number, Social Security number, and contact details. Create a Username and Password: select a strong, unique username and password for your online banking account. Set Up Security querys: Answer security querys to help verify your identity in case you forget your password. Activate Your Account: Follow the instructions to activate your account and start using BBT online banking.

Related Post : huntington bank online business

Tips for Safe Online Banking with BBT. While BBT implements robust security measures, it’s also crucial for users to take precautions to protect their accounts: Use Strong Passwords: Create strong, unique passwords that are difficult to guess. Keep Your Information Private: Never share your username, password, or other sensitive information with anyone. Be Wary of Phishing Scams: Be cautious of suspicious emails or phone calls asking for your personal information. Keep Your Software Updated: Ensure your computer and mobile devices have the latest security updates and antivirus software. Monitor Your Account Regularly: Check your account activity regularly for any unauthorized transactions.

In conclusion, BBT’s online banking platform offers a secure, convenient, and efficient way to manage your finances. By understanding its attributes, security measures, and user-friendly interface, you can take full benefit of the benefits it offers. Embrace the digital age and experience the ease of banking online with BBT!