In today’s digital age, managing your business finances online is not just a convenience, it’s a requirement. Huntington offers a robust online banking platform designed to empower businesses with the tools and resources they need to succeed. Whether you’re a small startup or a large corporation, Huntington’s online business banking solutions can help you streamline your financial operations, improve cash flow management, and make informed decisions. Let’s explore the world of Huntington online banking and discover how it can benefit your business.

The Rise of Online Business Banking: A Modern requirement. In today’s fast-paced business environment, efficiency and accessibility are paramount. Online banking has emerged as a critical tool for businesses seeking to streamline their financial operations and stay ahead of the competition. Huntington understands these needs and offers a thorough online banking platform tailored to the unique requirements of businesses.

Huntington’s Online Banking Platform: attributes and benefits. Huntington’s online banking platform is designed to offer businesses with a seamless and secure banking experience. Key attributes include: Account Management: View balances, transaction history, and statements for all your Huntington accounts. Funds Transfer: Easily transfer funds between accounts, both within Huntington and to external banks. Bill Payment: Pay bills online quickly and securely, saving time and reducing paperwork. ACH Payments: Initiate and manage Automated Clearing House (ACH) payments for payroll, vendor payments, and more. Remote Deposit: Deposit checks remotely using your computer or mobile device. Mobile Banking: Access your accounts and perform transactions on the go with Huntington’s mobile app. Security attributes: Huntington employs advanced security measures to protect your account information and prevent fraud.

Huntington Business Banking: Tailored Solutions for Your Business. Huntington offers a scope of business banking solutions designed to meet the specific needs of businesses of all sizes. Whether you’re a small startup or a large corporation, Huntington has the tools and resources to help you manage your finances effectively. These solutions include: Business Checking Accounts: select from a variety of checking accounts with attributes like unlimited transactions, interest-bearing options, and cash management tools. Business Savings Accounts: Earn interest on your business savings with rival rates and flexible access to your funds. Business Loans and Lines of Credit: Access the capital you need to grow your business with Huntington’s business loans and lines of credit. Merchant Services: Accept credit and debit card payments from your customers with Huntington’s merchant services solutions. Treasury Management: Streamline your cash flow and maximize your working capital with Huntington’s treasury management services.

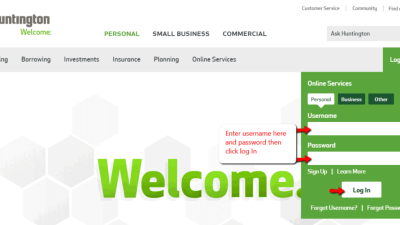

Getting Started with Huntington Online Business Banking. Opening a Huntington online business banking account is a straightforward process. You can apply online or visit a local Huntington branch to speak with a business banking specialist. During the application process, you’ll need to offer information about your business, including its legal name, address, and tax identification number. Once your account is approved, you’ll receive login credentials to access the online banking platform. Huntington also offers training and support to help you get the most out of your online banking experience.

Related Post : hsbc uk banking online

Tips for Maximizing Your Huntington Online Business Banking Experience. To make the most of your Huntington online business banking account, consider the following tips: Set up alerts: Receive notifications for crucial account activity, such as low balances or large transactions. Use strong passwords: Protect your account with strong, unique passwords and change them regularly. Monitor your account activity: Regularly review your account statements and transaction history to determine any unauthorized activity. Take benefit of mobile banking: Use Huntington’s mobile app to manage your accounts on the go. Contact Huntington’s customer support: If you have any querys or need assistance, don’t hesitate to contact Huntington’s customer support team.

In conclusion, Huntington’s online banking platform offers a robust suite of tools and services designed to empower businesses of all sizes. By leveraging the convenience and security of online banking, businesses can streamline their financial operations, improve cash flow management, and focus on achieving their strategic objectives. Huntington’s commitment to innovation and customer satisfaction makes it a trusted partner for businesses seeking to thrive in today’s dynamic industryplace. Embrace the power of Huntington online business banking and unlock your business’s full potential !