In today’s digital age, opening a business bank account online has become a convenient and efficient way for entrepreneurs to manage their finances. Gone are the days of lengthy paperwork and time-consuming visits to physical bank branches. With just a few clicks, you can establish a business bank account from the comfort of your own home or office. This article will guide you through the process of opening a business bank account online, highlighting the benefits, steps involved, and key considerations to ensure a smooth and achievementful experience. Whether you’re a startup founder or an established business owner, understanding how to open a business bank account online is essential for managing your finances effectively. An online business account offers numerous benefits, including ease of access, lower fees, and streamlined banking processes. Let’s explore how you can leverage the power of online banking to simplify your business finances and focus on what matters most: growing your business.

Why Open a Business Bank Account Online?

In today’s fast-paced business world, time is of the essence. Opening a business bank account online offers numerous benefits over traditional brick-and-mortar banking. The most significant benefit is convenience. You can complete the entire application process from the comfort of your home or office, eliminating the need to visit a physical branch. This saves you valuable time and allows you to focus on growing your business.

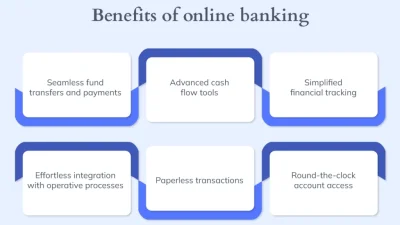

Another key benefit is accessibility. Online banks often offer 24/7 access to your account, allowing you to manage your finances anytime, anywhere. This is particularly beneficial for businesses that operate outside of traditional banking hours or have multiple locations. Furthermore, online banks often offer a wider scope of services and attributes, such as online bill pay, mobile check deposit, and advanced reporting tools.

Choosing the Right Online Business Bank Account

Related Post : setup business bank account online

With numerous online banks vying for your business, selecting the right one can feel overwhelming. Start by determineing your specific business needs. Consider factors such as the size of your business, the volume of transactions you anticipate, and the types of services you require.

Next, study varied online banks and compare their offerings. Look for accounts with low fees, rival interest rates, and user-friendly online platforms. Pay close attention to the bank’s security measures and customer support options. Read reviews from other business owners to get a sense of their experiences with varied banks. Some popular online business bank account options include those offered by traditional banks with online divisions, as well as those from newer fintech companies specializing in online banking.

Preparing Your Documentation

Before you begin the online application process, gather all the necessary documentation. This typically includes your Employer Identification Number (EIN) , your business formation documents (such as articles of incorporation or articles of organization) , and personal identification for all authorized signatories on the account.

Be sure to have digital copies of these documents readily available, as you will likely need to upload them during the application process. Having all your documentation prepared in advance will streamline the application process and help you avoid delays.

The Online Application Process

The online application process for a business bank account is typically straightforward. You will start by visiting the bank’s website and locating the online application form. The form will ask for information about your business, including its legal name, address, and industry. You will also need to offer information about the business owners and authorized signatories.

Carefully review all the information you offer before submitting the application. Errors or omissions can delay the approval process. Once you have submitted the application, the bank will typically conduct a review to verify your information and assess your eligibility. This may involve checking your business credit history and contacting you for additional information.

Funding Your New Account

Once your application is approved, you will need to fund your new business bank account. Most online banks offer several options for funding your account, including electronic transfers from other bank accounts, wire transfers, and check deposits.

Be sure to check the bank’s minimum balance requirements and any associated fees for varied funding methods. Once your account is funded, you can begin using it to manage your business finances.

Opening a business bank account online is a game-changer for modern entrepreneurs. It offers unparalleled convenience, saves valuable time, and offers access to a wider scope of banking options. By carefully considering your business needs, comparing varied banks, and preparing the necessary documentation, you can seamlessly establish your online business bank account and set your business up for financial achievement. Embrace the digital age and unlock the potential of online banking for your business today!