In today’s digital age, running an online business offers unparalleled flexibility and opportunities. However, managing your finances effectively is crucial for achievement. One of the first steps in establishing a solid financial foundation is opening a dedicated online business bank account. This article will guide you through the process of finding an easy account that meets your specific needs, helping you streamline your financial operations and focus on growing your online business.

The world of online business is booming, and having the right tools is essential for achievement. A dedicated business account is one of those crucial tools, providing a clear separation between your personal and business finances. But with so many options available, finding the right one can feel overwhelming. This guide will help you navigate the landscape of online business banking and find an easy account that fits your needs.

Why You Need a Dedicated Business Account.

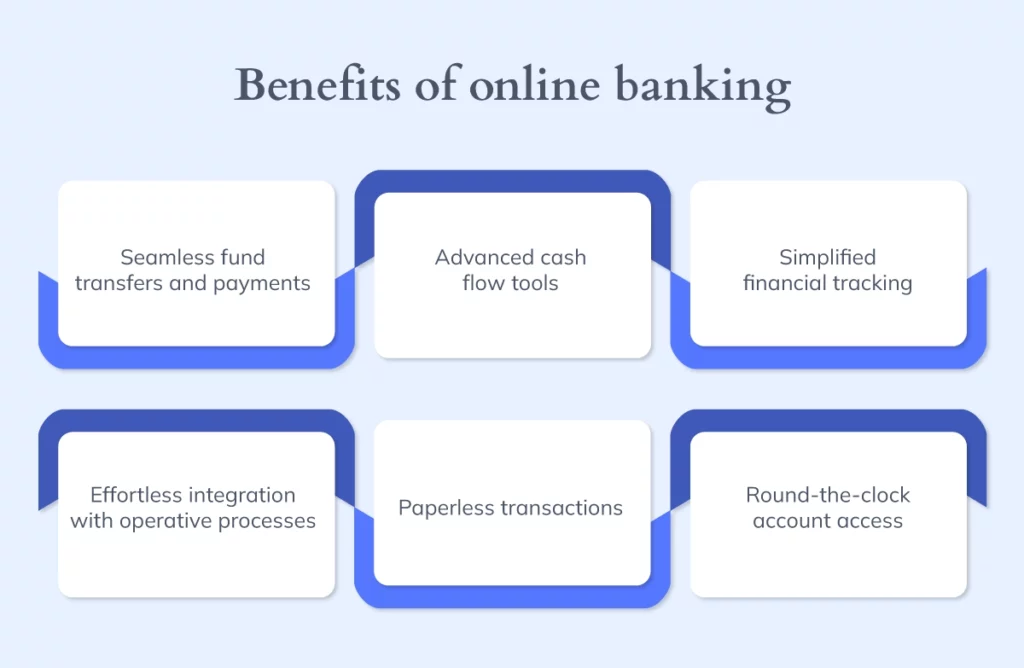

Mixing personal and business finances is a recipe for disaster. It complicates tax season, blurs the lines of liability, and makes it difficult to track your business’s financial health. A dedicated business account offers a clear separation, offering numerous benefits:

- Professionalism: It presents a more professional image to clients and vendors.

- Organization: It simplifies bookkeeping and financial management.

- Liability Protection: It helps protect your personal assets in case of legal issues.

- Tax Compliance: It makes tax preparation easier and more accurate.

Key attributes to Look for in an Easy Account.

Not all business accounts are created equal. When searching for an easy account for your online business, consider these essential attributes:

- Low Fees: Look for accounts with minimal monthly fees, transaction fees, and overdraft fees.

- Online Accessibility: Ensure the bank offers a user-friendly online platform for managing your account, paying bills, and transferring funds.

- Mobile Banking: A mobile app is essential for managing your finances on the go.

- Integration with Accounting Software: Seamless integration with popular accounting software like QuickBooks or Xero can save you time and effort.

- Debit Card: A business debit card allows you to make purchases and withdraw cash easily.

- Customer Support: select a bank with responsive and helpful customer support.

Top Online Business Bank Account Options.

Several online banks cater specifically to the needs of online businesses. Here are a few popular options:

- Novo: Known for its sleek interface and no-fee business checking accounts.

- Mercury: Offers banking solutions for startups and e-commerce businesses, with attributes like virtual cards and API access.

- Bluevine: offers high-yield checking accounts and lines of credit for small businesses.

- Lili: Designed for complimentarylancers and independent contractors, with attributes like expense tracking and tax preparation tools.

- Found: A business banking platform built for solopreneurs, offering tools for invoicing, payments, and bookkeeping.

Related Post : setup business bank account online

How to Open an Online Business Bank Account.

Opening an online business bank account is typically a straightforward process. Here’s what you’ll generally need:

- Business Formation Documents: This may include your articles of incorporation, articles of organization, or business license.

- Employer Identification Number (EIN): If you have a corporation, LLC, or partnership, you’ll need an EIN from the IRS.

- Personal Information: You’ll need to offer your name, address, date of birth, and Social Security number.

- Initial Deposit: Some banks may require a minimum initial deposit to open the account.

The application process usually involves filling out an online form and submitting the required documents electronically. The bank may also conduct a verification process to confirm your identity and business information.

Tips for Managing Your Online Business Finances.

Once you have your online business bank account set up, here are some tips for managing your finances effectively:

- Track Your Income and Expenses: Use accounting software or a spreadsheet to track all your income and expenses.

- Reconcile Your Account Regularly: Reconcile your bank statements with your accounting records to ensure accuracy.

- Set Up Automatic Transfers: Automate transfers to your savings account or for paying bills to avoid late fees.

- Monitor Your Cash Flow: Keep a close eye on your cash flow to ensure you have enough funds to cover your expenses.

- Consult with a Financial Professional: Consider consulting with an accountant or financial advisor for personalized advice.

Choosing the right online business bank account is a crucial step for any entrepreneur. By considering the factors discussed and exploring the options available, you can find an easy account that perfectly fits your business needs. Remember to prioritize security, accessibility, and affordability to ensure a smooth and achievementful banking experience. Good luck!