In today’s digital age, managing your business finances online is more convenient and efficient than ever. Opening an online business account can streamline your financial operations and offer you with access to a scope of valuable tools and services. But with so many banks offering online business accounts , how do you select the right one? This article will guide you through the process of selecting the optimal online account for your business, covering key attributes to look for, top bank recommendations, and tips for managing your account effectively.

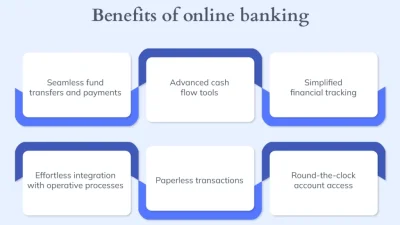

Why Open a Business Account Online? Opening an online account for your business offers numerous benefits. It offers a convenient way to manage your finances, separate your personal and business transactions, and access a scope of financial tools and services. With an online business account , you can easily track your income and expenses, pay bills, and manage your cash flow from anywhere with an internet connection.

Key attributes to Look For in an Online Business Account. When choosing an online account , consider the following attributes: Fees: Look for accounts with low or no monthly fees, transaction fees, or overdraft fees. Interest Rates: Some business accounts offer interest on your balance, which can help you grow your savings. Online Banking Tools: Ensure the bank offers a user-friendly online platform with attributes like online bill pay, mobile check deposit, and account alerts. Integration with Accounting Software: select a bank that integrates with popular accounting software like QuickBooks or Xero to streamline your bookkeeping. Customer Support: Opt for a bank with responsive and helpful customer support available via phone, email, or chat.

Top Banks for Online Business Accounts. Several banks offer excellent online business account options. Here are a few of the top contenders: Novo: Novo is a popular choice for small businesses and complimentarylancers, offering a no-fee business checking account with a sleek mobile app and integrations with popular business tools. Bluevine: Bluevine offers a business checking account with no monthly fees and the ability to earn interest on your balance. They also offer lines of credit to help businesses manage their cash flow. Chase Business Complete Banking: Chase offers a thorough business banking solution with a scope of attributes, including online and mobile banking, bill pay, and access to Chase’s extensive network of branches and ATMs. Bank of America Business benefit Banking: Bank of America offers a variety of business checking accounts to suit varied business needs, with options for earning rewards and accessing cash management tools. Mercury: Mercury is designed for startups and tech companies, offering a business checking account with no monthly fees and attributes like API access and team management tools.

How to Open a Business Account Online. Opening a business account online is typically a straightforward process. Here are the general steps involved: select a Bank: study and compare varied banks to find the one that optimal meets your needs. Gather Required Documents: You’ll typically need to offer your business’s legal name, address, EIN (Employer Identification Number), and formation documents (such as articles of incorporation or organization). Complete the Online Application: Fill out the online application form, providing all the required information. Verify Your Identity: You may need to verify your identity by providing a copy of your driver’s license or other government-issued ID. Fund Your Account: Once your application is approved, you’ll need to fund your account by transferring money from another bank account or making a deposit.

Related Post : setup business bank account online

Tips for Managing Your Online Business Account. Once you’ve opened your online business account , here are some tips for managing it effectively: Monitor Your Account Regularly: Check your account balance and transactions frequently to detect any unauthorized activity. Set Up Alerts: Enable account alerts to receive notifications about low balances, large transactions, or other crucial events. Reconcile Your Account Monthly: Reconcile your account statements each month to ensure that your records match the bank’s records. Use Online Banking Tools: Take benefit of the online banking tools offered by your bank to manage your finances efficiently. Protect Your Account Information: Keep your account login credentials secure and never share them with anyone.

Choosing the right bank for your online business account is a crucial decision. By carefully evaluating your needs and comparing the options available, you can find a bank that supports your business objectives and helps you thrive in the digital industryplace. Remember to consider factors like fees, attributes, and customer service to make an informed choice. Good luck!